Drake Tax - AL: Overtime Exemption Act

Article #: 18702

Last Updated: November 03, 2025

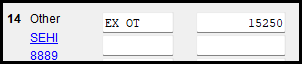

In Drake Tax, in the first column under 14 Other, enter code EX OT and then enter the amount of exempt overtime wages in the second column.

Tip The Form W-2 may have a longer description for box 14, but it can be shortened to EX OT, according to AL guidelines.

This exemption applies to both resident and nonresident taxpayers. If the amount in Box 16 was not adjusted by the employer, the taxpayer may need a corrected Form W-2.

See the AL DOR website for details.