Drake Tax - Family Healthcare Coverage

Article #: 11461

Last Updated: December 05, 2024

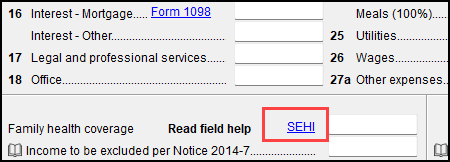

An entry for family healthcare coverage can be made on the C or F screens, towards the bottom of the window. On the C screen, a link to the SEHI screen is available on that line for additional entries regarding the Self Employment Health Insurance (SEHI) deduction.

An amount typed in the Family health coverage field on screen C will not carry to Schedule 1, line 16 unless Schedule C shows a net profit.

An adjustment field is also available on screen 4, line 16 for the SEHI deduction. If there is a 1095-A on the return see Drake Tax - Self-Employment Health Insurance Deduction.

Note The SEHI screen also has a data entry point (line 11) for Medicare wages from an S corporation. If an insurance plan was established under an S corporation for a taxpayer who is at least a 2% shareholder, wages from that S corporation may need to be entered in this field. For more information see Corporation Compensation and Medical Insurance Issues.

For more information see IRS Publication 535, Business Expenses.