Drake Tax - Premium Tax Credit (PTC) Under the ACA

Article #: 12681

Last Updated: December 05, 2024

The Premium Tax Credit, or PTC, helps eligible families with low or moderate incomes in purchasing affordable health insurance coverage. It is a refundable tax credit for which the taxpayer may receive advance payments. For information about the PTC, see:

-

the IRS web pages

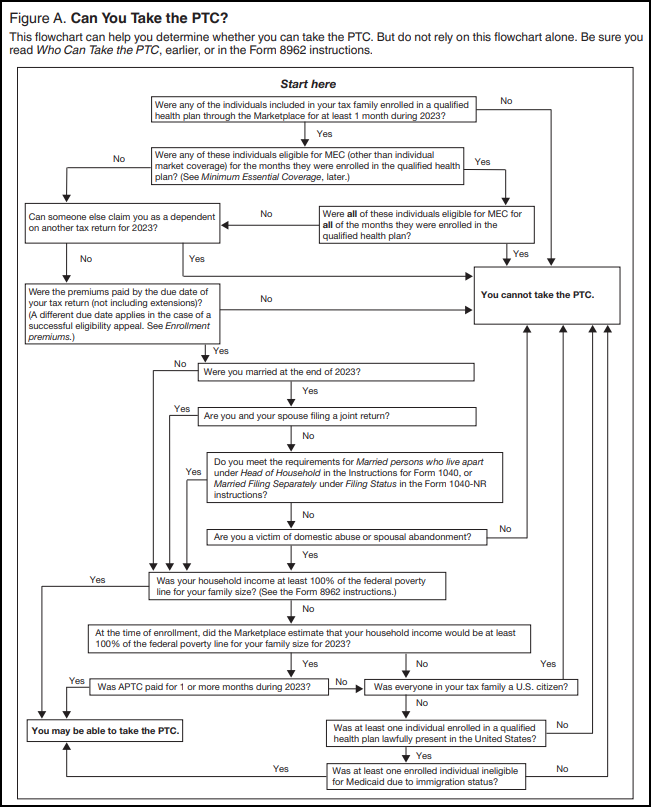

Taxpayer Eligibility

If eligible, a taxpayer can choose to have some or all of the estimated credit paid in advance directly to the taxpayer's insurance company to lower out-of-pocket for monthly premiums, or the taxpayer can wait to get all of the credit when a tax return is filed.

Advance Payments

If the taxpayer chooses to receive advance payments, the taxpayer must file a federal 1040 income tax return whether or not they are otherwise required to file. See "24. Will I have to file a federal income tax return to get the premium tax credit?" at Questions and Answers on the Premium Tax Credit.

When the tax return is filed, the total advance payments are subtracted from the amount of the Premium Tax Credit calculated on the return. If the PTC is more than the advance payments made on the taxpayer's behalf during the year, the difference increases the refund or lowers the balance due. If the advance payments are more than the credit, the difference increases the amount owed and may result in a smaller refund or a balance due.

Note The American Rescue Plan Act of 2021, enacted on March 11, 2021, suspended the repayment of excess advanced premium tax credit (APTC) amounts for tax year 2020. See Suspension of Repayment of Excess Advance Payment of the PTC for more information.

Claim Credit

When the taxpayer's tax return is filed claiming the PTC in its full amount, the refund may be increased or the balance due may be lowered.

Household Income

For purposes of this credit, the taxpayer's household income is the Modified Adjusted Gross Income (MAGI) plus that of every other individual in the taxpayer's family for whom the taxpayer can claim a personal exemption deduction and who is required to file a federal income tax return.

To determine the MAGI, see "Worksheet X. Figuring Household Income and the Limitation on Additional Tax" in Publication 974.

Changes in Income or Family Size

If the taxpayer's family size or household income changes, the taxpayer should notify the Marketplace to update the information used to determine the expected amount of the credit and adjust the advance payment amount. See "4. What happens if my income or family size changes during the year?" at Questions and Answers on the Premium Tax Credit:

"Notifying the Marketplace about changes in circumstances as soon as they occur will allow the Marketplace to update the information used to determine your expected amount of the premium tax credit and adjust your advance payment amount. This adjustment will decrease the likelihood of a significant difference between your advance credit payments and your actual premium tax credit. Changes in circumstances that can affect the amount of your actual premium tax credit include:

-

Increases or decreases in your household income, including lump sum payments like a lump sum payment of Social Security benefits or taxable distributions from an individual retirement account or other retirement arrangement

-

Marriage

-

Divorce

-

Birth or adoption of a child

-

Other changes to your household composition

-

Gaining or losing eligibility for government sponsored or employer sponsored health care coverage

-

Moving to another address."

Income Limits

In general, individuals and families whose household income for the year is between 100% and 400% of the federal poverty line (FPL) for their family size may be eligible for the PTC.

Modified AGI (or MAGI)

Worksheet WK_89621 contains a section figuring the taxpayer’s modified AGI for line 2a of Form 8962. Review this worksheet in View/Print mode of the return.