Drake Tax - CO - Excluding Death Benefits

Article #: 14178

Last Updated: December 05, 2024

If the taxpayer or spouse was not 55 years of age as of December 31, they do not qualify for the pension exclusion unless they are receiving the pension as a secondary beneficiary (such as a widow or a dependent child) due to the death of the person who earned the pension, in which case they may exclude the smaller of such income or $20,000.

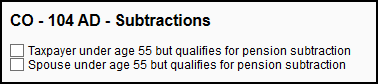

To exclude a 1099-R that was issued due to death to someone under the age of 55, you can go to the States tab > CO > screen 2 (104 Additions and Subtractions). In the Subtractions section, select Taxpayer/Spouse under age 55 but qualifies for pension subtraction check box. The pension subtraction will show on CO 104 AD, line 3 (for taxpayer) or line 4 (for spouse).

For more information on CO pension subtractions, see the CO 104 Booklet.