Drake Tax - 1065 - Appointed Representative (Tax Matters Partner)

Article #: 15031

Last Updated: July 22, 2025

Due to IRS Audit Rules, partnerships must appoint a Partnership Representative. Unlike the Tax Matters Partner, the Partnership Representative does not have to be a partner in the partnership. The software will not automatically select a Partnership Representative.

Caution The representative has "complete authority to act on behalf of the partnership" when dealing with the IRS. This includes legally binding the partnership (and therefore, the partners) in terms of audits and other IRS proceedings.

If either of these messages are produced, you will not be able to e-file until they are cleared:

-

If a Tax Matters Partner has not been selected, the software will produce EF Message 0933.

-

If more than one Tax Matters Partner has been selected, EF Message 0245 will be produced.

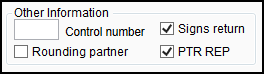

If the Partnership Representative is a partner, go to the K1 screen for that partner, and check the PTR REP box on the top left corner under the Other Information section.

Not a Partner

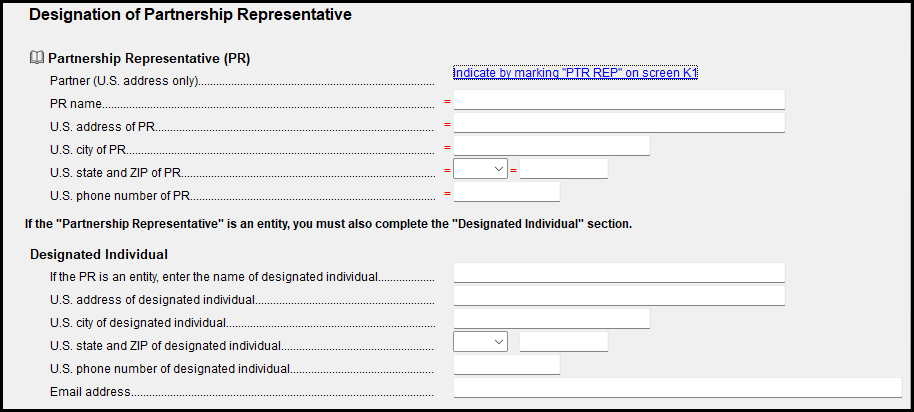

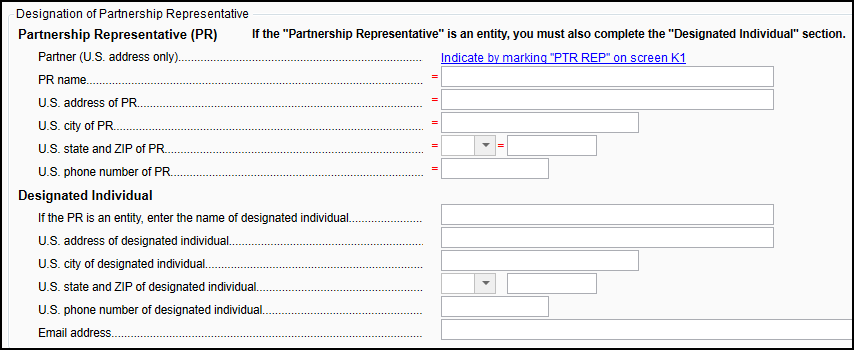

If the Partnership Representative is not a partner, you will need to complete the B4 screen. These fields are marked as overrides, however, they only override information if there is a representative indicated on the K1 screen.

The Partnership Representative Form is shown on Schedule B, at the bottom of Form 1065, page 4, and can be different from the person who signs the return.

If the Partnership Representative is not a partner, you will need to go to the B screen > Schedule B, cont. tab and enter their information in the Designation of Partnership Representative section. These fields are marked as overrides, however, they only override information if there is a representative indicated on the K1 screen.

The Partnership Representative Form is shown on Schedule B, at the bottom of Form 1065, page 4, and can be different from the person who signs the return.

If the Partnership Representative is not a partner, you will need to go to the B screen > Schedule B, cont. tab and enter their information in the Designation of Partnership Representative section. These fields are marked as overrides, however, they only override information if there is a representative indicated on the K1 screen.

The Partnership Representative Form is shown on Schedule B at the bottom of Form 1065, page 3, and can be different from the person who signs the return.