Drake Tax - 1065 - Centralized Partnership Audit Regime

Article #: 15902

Last Updated: December 05, 2024

The centralized partnership audit regime was enacted as part of the Bipartisan Budget Act of 2015, also known as the BBA. It allows the IRS to assess and collect tax at the partnership level for eligible partnerships instead of the tax being assessed at the partner level.

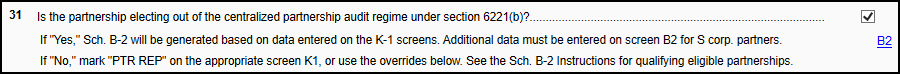

Schedule B-2 was created for the purpose of allowing certain partnerships with 100 or less partners to elect out of the centralized partnership audit regime. The election occurs on the main 1065 form on Schedule B, line 31 (if answered “Yes”). There are strict rules about the eligibility of the partnership to elect out. The software will automatically create the Schedule B-2, if question 25 on Schedule B is answered “Yes”, based on data entered on the K-1 screens. There are messages in place to alert the preparer if data entry is incorrect or indicates the partnership is not eligible to make the election.

In a partnership return:

-

Go to screen B, Schedule B - Other Information

-

Click on Schedule B, cont. at the top of the window or press the Page Down key on your keyboard.

-

If the partnership is electing out of the centralized partnership audit regime, check the box on Line 31

-

Otherwise complete the Designation of Partnership Representative section following line 31.

-

-

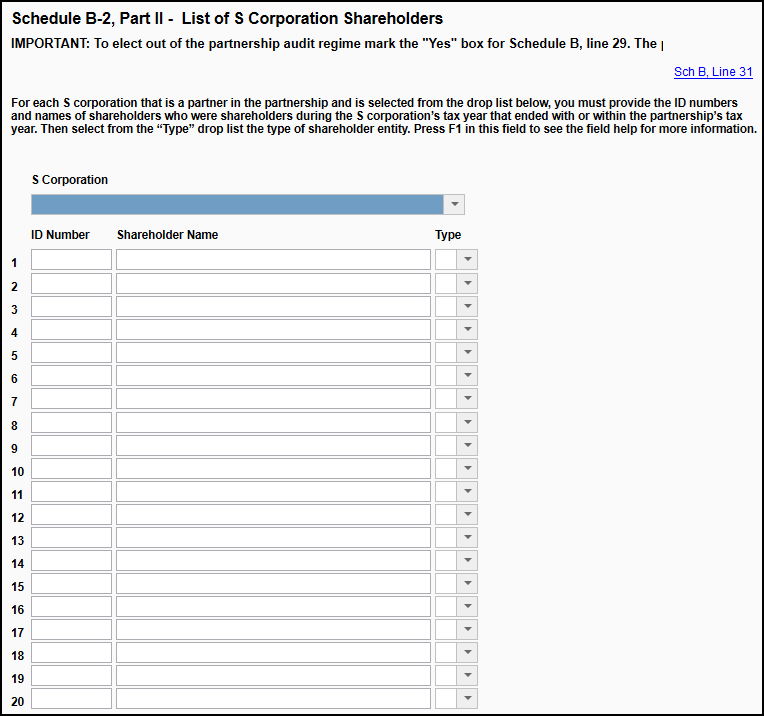

If any of the partners are S corporations, click on the Schedule B-2 link to access screen B2, Schedule B-2 Audit Election.

-

On screen B2, Schedule B-2 Audit Election, select the partner that is an S corporation (This must be designated on screen K1).

-

Manually enter the ID, Name, and Type for each shareholder of that S corporation.

-

If there are multiple S corporation partners in the partnership, press Page Down on your keyboard to create a new record for the next S corporation partner and return to Step 6.

-

Go to View/Print mode to check for any diagnostic messages and review Schedule B-2 for accuracy.

Note The only manual entries for Schedule B-2 are for selecting S corporation partners and listing their related shareholders. All other information will flow from screen K1 entries.

Invalid entity types.

Entity types that will invalidate your election are the following.

-

Partnerships

-

Trusts

-

Foreign entities not treated as C corporations if they were domestic entities

-

Disregarded entities described in Regulations 301.7701-2(c)(2)(i)

-

Estates of individuals other than those of deceased partners

-

Persons that hold an interest in the partnership on behalf of another person

Note You can select if the partner is a foreign entity that would be treated as a C corporation if it were a domestic entity on the K1 screen by selecting, B2 - Eligible Foreign Entity.