Drake Tax - Schedule A - Force Itemized or Standard Deduction

Article #: 16988

Last Updated: July 22, 2025

To force a return to use the itemized deduction, go to federal screen A - Itemized Deduction Schedule in Data Entry and mark the Force itemized check box at the top. To make it use the standard deduction, mark Force standard.

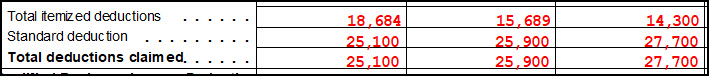

Drake Tax automatically calculates whether itemized deductions or the standard deduction are more advantageous to the taxpayer. Starting in Drake Tax 2023, you can also see a summary of the deduction amounts and which one was applied by viewing the Comparison page in view mode.

If a multi-state return, be sure to choose the state abbreviation on the ST drop list. For states that allow you to force a different deduction type or override the amount(s), see state-specific data entry locations as follows:

| State | Screen Code |

|---|---|

| Alabama | A |

| Arizona | A |

| Arkansas | A |

| California | ITEM |

| Delaware | 1 |

| Georgia | 1 |

| Hawaii | ITEM |

| Idaho | 3 |

| Iowa | A |

| Kansas | SCHA |

| Kentucky | A |

| Maine | ITEM |

| Maryland | 1 or 2 |

| Minnesota | MNA |

| Mississippi | A |

| Missouri | 1 |

| Montana | SCH3 |

| New York | 2 |

| North Carolina | 1 |

| Oklahoma | 511 |

| Oregon | A |

| Rhode Island | 40 |

| Utah | 1 |

| Vermont | 1 |

| Virginia | 1 or ITEM |

| Wisconsin | 2 or I |

Related Links

Drake Tax - Schedule A - State and Local Income Tax Deduction Limitation (Wks SALT)