Drake Accounting - Sales Tax Setup

Article #: 15882

Last Updated: December 05, 2024

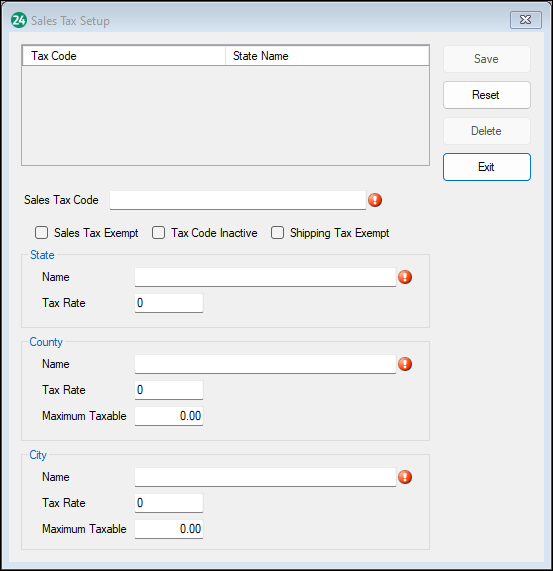

State Sales Tax can be setup by going to:

-

Receivables > Sales Tax Setup and click New.

-

Enter a Sales Tax Code. Sales tax codes are alphanumeric and can be up to 20 characters long. Once these codes are saved, these can be used in Customer Setup (to assign a default for each customer) and when entering/updating invoices.

-

Select the check boxes that are appropriate for the sales tax code being entered.

-

Sales Tax Exempt — The selected entity does not charge sales tax. The sales tax information is removed from the record.

-

Tax Code Inactive — Select Tax Code Inactive when the selected Tax Code should not be used. Inactive codes do not appear as a choice when entering or updating invoices.

-

Shipping Tax Exempt — The selected entity does not charge sales tax on shipping charges.

-

-

Enter information for the recording of sales tax. When entering multiple records for a state or county, repeat the appropriate higher-level information.

-

Name — Enter a name for the sales tax.

-

Tax Rate — Enter the tax rate as a decimal. A tax rate of 6% should be entered as 0.06.

-

Maximum Taxable — If there is a maximum amount that is subject to this county's or city's sales tax, enter that amount.

-

-

Save each record before entering the next.

-

Delete

-

To delete a previously saved sales tax record, click the State Name or Tax Code of the record to delete.

-

The information for that sales tax record displays in the Sales Tax Information section.

-

Click Delete then click Yes to confirm.

-

-

Reset

-

Click Reset to revert to the last saved sales tax information for this sales tax record.

Note While the Name and Tax Rate for a State or County does not have to be entered for the City Tax information to be used, it is recommended that all preceding entities be given names, even if the rates (or maximums) remain zero.

-