Drake Tax - IL - Tax-Exempt Interest

Article #: 10236

Last Updated: December 05, 2024

Some specific bond and interest income qualifies as a subtraction from IL state income on the IL 1040, however, Illinois tax exempt interest does not flow automatically from the federal return to the Illinois return. You must identify the IL interest source category on the federal INT or DIV screen. Since Illinois has more than one subtraction line, the type of subtraction must be selected.

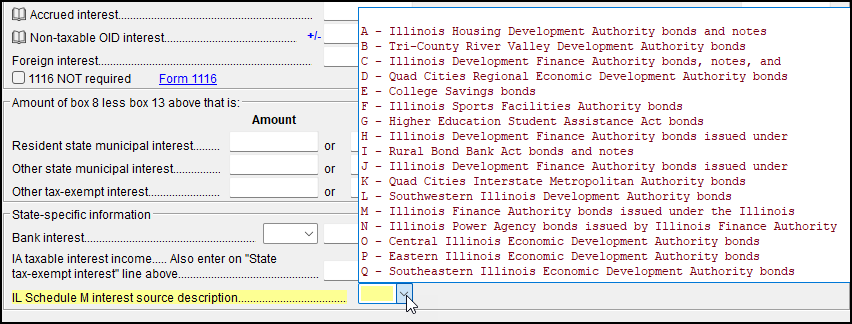

On the federal INT or DIV screen, select the appropriate IL description from the drop list in the IL Schedule M interest source description field at the bottom of the screen:

You can override these subtractions on IL screen M2. When interest should be assigned to more than one category, for example, an IL screen M2 override may be necessary.

Illinois has 29 categories of qualified interest deductions, listed on lines 32-33 of Schedule M - Other Subtractions and on the INT screen drop list. The person best suited to deal with the intricacies of these deductions is a professional tax preparer. For more information, see the IL Publication 101 and the IL 1040 Instructions.