Drake Tax - IL - 1065/1120-ST Line 35, Box A or B

Article #: 18475

Last Updated: November 03, 2025

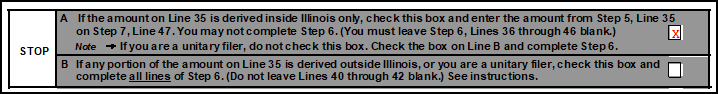

Box A is marked instead of B on the section below line 35, "Base income or loss," on Form IL-1065 or IL-1120-ST. This section is completed automatically based on your data entry:

Box A is marked if both of the following are true:

-

All of the base income or loss is derived inside Illinois.

-

There is no income or loss to report on line 36, 37, 44, or 45.

In this case, nothing carries to Step 6, and the amount from Step 5, line 35 flows to Step 7, line 47

Box B is marked if any of the following apply:

-

The base income or loss is derived inside and outside Illinois.

-

All of the base income or loss is derived outside Illinois.

-

There is income or loss to report on line 36, 37, 44, or 45.

In this case, all lines in Step 6 must be completed. See the IL 1065 or 1120-ST instructions for details.

Note NOTE: If the partnership or S corporation received a K-1 from another pass-through entity, the following amounts on IL screens K1P and K1T flow to the applicable line on Form IL-1120-ST or IL-1065, which causes box B to be marked:

Flows to Step 6, line 37

• IL screen K1P: Member’s Share column (A), sum of lines 32 - 37 minus sum of lines 38a (or 38b) - 47

• IL screen K1T: Beneficiary’s Share column (A), sum of lines 30 - 35 minus sum of lines 36a (or 36b) - 45

Flows to Step 6, line 45

• IL screen K1P: Allocable to IL column (B), sum of lines 20 - 31

• IL screen K1T: Illinois share column (B), sum of lines 19 - 29

Entries and overrides for Step 6 are available on IL screen 2. You cannot force a selection for Box A or B, as it follows the state guidelines detailed above.