Drake Tax - MD: State Pickup Amounts

Article #: 11337

Last Updated: July 22, 2025

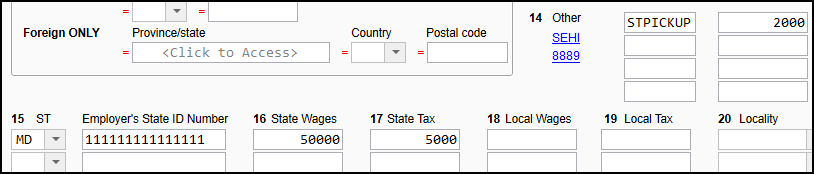

To enter a MD state pickup related to Form W-2 income:

-

Open the W2 screen for the MD Form W-2 (box 15 has MD).

-

Enter the literal STPICKUP in box 14.

-

Enter the state pickup amount in the box to the right.

-

In View/Print mode, the state pickup amount appears on:

-

Form 502, line 3 (resident).

-

Form 505, line 19, code G (nonresident).

-

EF Message 0290

To clear EF Message 0290, ensure that box 16 (state wages) is not greater than box 1 (wages) on screen W2.

Tip If you are attempting to add back the MDSTPICKUP to box 16 manually, remove it from the W2 screen as it is added back already.

Form 1099-R

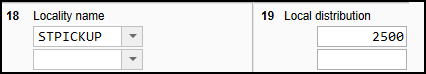

To enter a MD state pickup related to Form 1099-R:

-

Open the 1099 screen for the MD Form 1099-R (box 15 is MD).

-

In box 2a, Taxable amount, make sure that there is an amount entered.

-

In box 18, enter the literal STPICKUP as the Locality name.

-

Enter the amount in the Local distribution field (box 19).

-

In View/Print mode, the state pickup contribution carries to MD 502, line 13, with a code of R.

Important The amount entered in box 19 for the MD STPICKUP cannot be more than the taxable amount (box 2a). The taxpayer cannot get a deduction for more than was included as income.

EF Message 0008

To clear EF Message 0008, check the following entries on every 1099 screen:

-

box 14 - must have an amount entered (even if 0).

-

box 16 - should generally be the same as box 2 (unless the taxpayer is a part-year resident).

-

box 17 - should have no amount (not even 0).