Drake Tax - MD - Form 505 - Taxes Withheld in Error

Article #: 18170

Last Updated: July 22, 2025

If you are a nonresident of Maryland, you are not required to file a Maryland return if any of the following are true:

-

Your Maryland gross income is less than the minimum filing level for your filing status;

-

You had no income from Maryland sources;

-

You reside in the District of Columbia, Virginia or West Virginia and had only wages from Maryland.

-

You reside in a local jurisdiction in Pennsylvania, which does not impose an income or earnings tax against Maryland residents, and had only wages from Maryland.

Tax Withheld in Error

If Maryland tax was withheld from your income, you must file a return to claim a refund.

Note When using this option, you cannot claim any additional adjustments (ex. student loan or IRA adjustments) for Maryland.

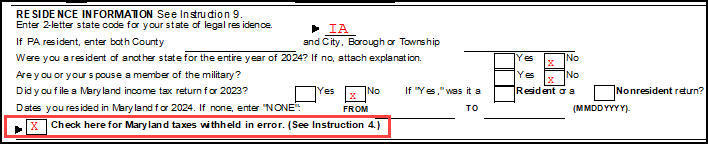

In Drake Tax, generate the return by completing at least federal screens 1 and W2, and MD screen 2. If the taxpayer is a resident of DC, VA, WV, or PA, the software checks the box Check here for Maryland taxes withheld in error check box on page 1 of Form 505 and calculates the refund automatically based on your entries.

Tip If the taxpayer is a resident of PA, you must enter the PA Resident County at the bottom of MD screen 2 to avoid EF Message 0057.

Override

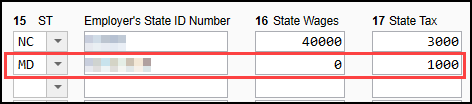

If the taxpayer was not a resident of DC, VA, WV, or PA, on screen W2, enter a zero under the State Wages column for the MD row. This will allow the Check here for Maryland taxes withheld in error box on page 1 of Form 505, Nonresident Income Tax Return to be marked when there is an amount of state tax withheld on Form W-2, but no state wages have been entered.

If there were actual wages reported on the Form W-2 issued, this information may not be applicable; see the Nonresident Tax Booklet for details.

On MD Form 505: