Drake Tax - TX - Generating Texas Franchise Reports

Article #: 16181

Last Updated: November 03, 2025

-

Beginning with Drake Tax 2024, only the current report year is available in business returns.

-

Prior-year franchise tax returns can be filed online at the Texas Comptrollers website.

There are a few required entries that must be made before the TX report will be generated in an individual return. The correct business schedule must be specified, the appropriate Texas specific Taxpayer ID number must be entered, and the 05-102, Personal Information Report, must be filed with every report. See the steps below for more information.

Note Not all 1040 businesses are subject to the Franchise Tax.

Generally, eligible entities are limited to Single Member LLCs that file a Federal Schedule C, Schedule E, or Schedule F. To ensure the correct entities are included, the Texas report must have a corresponding Federal schedule. Minimum required data entry is as follows:

-

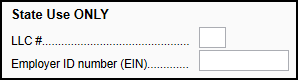

On the Federal Schedule C, E, or F screen, enter an identifying number (1-99) for the LLC in the LLC# box in the State use ONLY section located on the Carryovers/State Info tab.

-

For example, on the first LLC for this return, enter a 1 in the LLC# box.

-

-

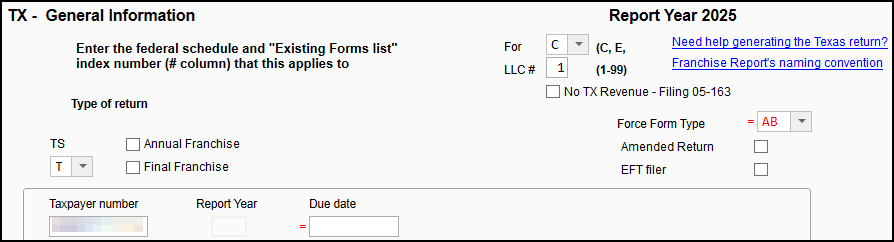

In TX data entry, go to screen 1 Reporting Entity > Gen Info tab and make the following entries:

-

For: In the For drop down, select C, E, or F to indicate which Federal schedule is the SMLCC.

-

LLC #: Enter the applicable LLC number (1 - 99) that indicates to which Federal C, E, or F screen the TX report applies.

-

TS: Choose T for Taxpayer or S for Spouse. This must match the selection on the Federal C, E, or F screen.

-

Taxpayer Number: This unique identifying ID number must exist and be correct. It is an 11-digit number, supplied by the Texas Comptroller’s Office.

-

-

The 05-102, Public Information Report, must be filed with the Texas Report. To complete this, go to the 05-102 PIR tab on TX screen 1.

-

If there are no changes to the directors or officers, check the box at the top of the screen that says There are currently NO CHANGES to the officers or directors.

-

If there are changes, enter the changes to generate the report.

-

Business Returns

You can generate a Texas Franchise report in a 1065, 1120, 1120-S, 1041, or 990 return by making entries on the applicable Texas screens.

-

On TX screen 1, you can force the form type, if needed.

-

The Web File Number is required for e-filing; see Drake Tax - TX - Franchise Report EF Message 0036 Web File Number for more information.

-

See the TX FAQ page for more tips.

Tip If the return is rejected, see Drake Tax - TX - Common EF Rejects for solutions.