Drake Tax - 1120-S: Entering Officer Information - Form 1125-E

Article #: 16986

Last Updated: July 22, 2025

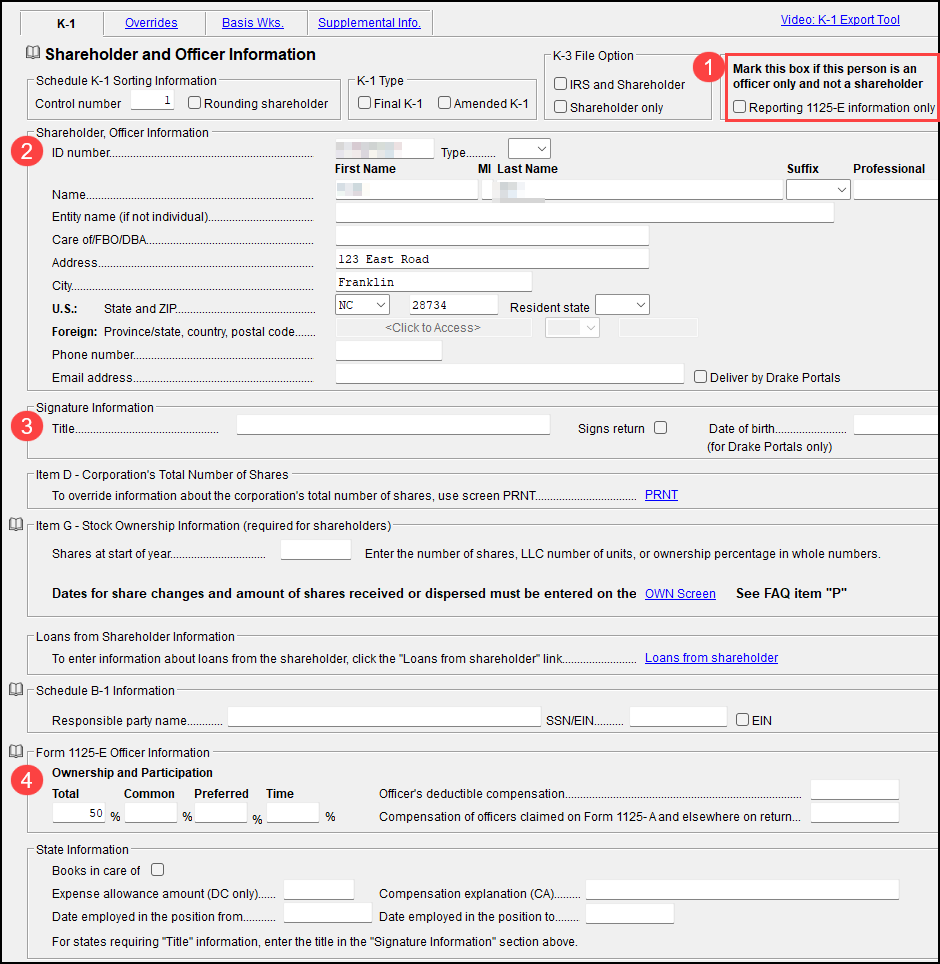

Use the K1E screen to enter information for officers and shareholders.

-

The Shareholder, Officer information section (2) should be completed for all shareholders and officers.

-

If a shareholder or officer has applied for an EIN, SSN, or ITIN, enter APPLD FOR in the ID number field.

Important Per IRS, the entry FOREIGNUS is no longer a valid entry for e-filing purposes starting with 2023. EF Message 0701 generates to prevent e-file until a valid entry is made.

-

-

In the Signature information section (3), a Title should be entered for all officers. Check the Signs Return box, if applicable.

Tip If this box is marked, the contact officer's information is used for Form 1120-S and Form 8879-C. The Officer's PIN and signature date are entered on the PIN screen.

-

For officers that are not shareholders, check the box Reporting 1125-E information only at the top right of the K1E screen (1).

-

The Item G - Stock Ownership Information section (4) should be completed for all shareholders and officers that also hold shares. See Drake Tax - 1120-S - Schedule K-1, Item D for more information.

-

If a shareholder is an entity (not an individual), you may need to complete Schedule B-1 Information - section (5). Per the instructions, Schedule B-1 is used to provide info about a shareholder that is "...a disregarded entity, a trust, an estate, or a nominee or similar person at any time during the tax year." If this applies, select the shareholder's entity Type from the drop list beside ID Number. Then, complete the section Schedule B-1 Information with the Responsible party name and their SSN/EIN. See Schedule B-1 (1120-S) for more information about who must file Schedule B-1. EF Message 0076 generates if you have selected an entity type, but have not completed the other required fields.

-

Form 1125-E Officer Information section (6) should be completed as applicable for all shareholders and officers.

Note Employment Dates - If an entry is made in the Date employed in the position to field (indicating that the officer is no longer employed with the corporation), the program will not update the officer’s information to the next year.

Ownership and Participation - To enter the ownership percentage for the officer, enter the percentage as a whole number. For example, enter 40 to indicate 40 percent.

Generating Form 1125-E

Form 1125-E, Compensation of Officers is not generated automatically with the return unless required. Total receipts (line 1a, plus lines 4 through 10) on Form 1120-S must be $500,000 or more.

To force the software to print Form 1125-E, on the PRNT screen select Force-print Form 1125-E, Officer Information at the top left under Items to Print.

Screens K1E compensation amount totals are calculated and carried to Form 1120-S, line 7.

The total of officer compensation can be entered in the Officer Compensation override field on the DED screen (generally used when Form 1125-E is not required). An entry in that field overrides any calculations from screen K1E, changing the 1120-S, but not Form 1125-E.