Drake Tax - 1120-S: Entering Built-In Gains

Article #: 13588

Last Updated: November 03, 2025

First

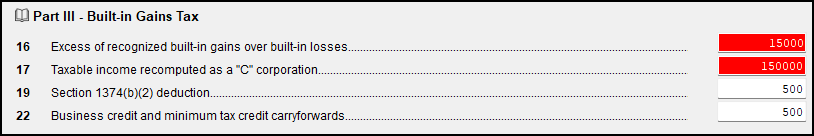

To begin entering info for built-In gains, go to the Assets-Sales-Recapture tab, select the D2 screen, and locate the Part III - Built-In Gains Tax section.

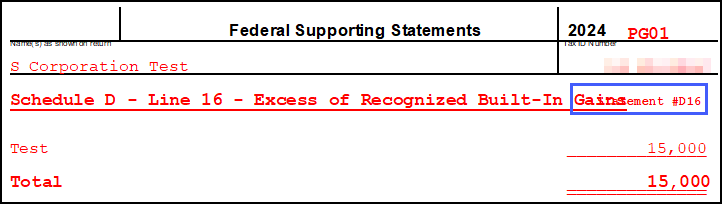

Line 16 is an automatic worksheet entry point and opens to a worksheet similar to a Ctrl + W worksheet.

It creates a STATMENT document, with Statement #D16 in View/Print mode:

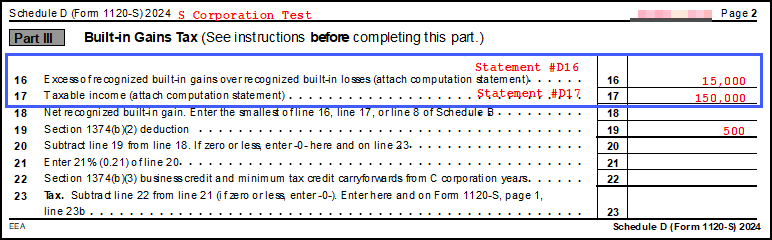

You need an entry on lines 16 and 17 because Part III of Schedule D compares these two lines and the amount entered on screen B line 8, flowing the smaller of the three to line 18.

Lines 19 and 22 represent deductions/credits that will take place in Part III of Schedule D (as you can see above). They will subtract from, or make less, the end result.

Line 19 subtracts from line 18, leaving that amount (on line 20) to be multiplied by 21% on line 21.

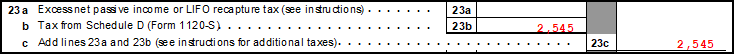

Line 21 is then affected by line 22 (subtracts from it). The result flows to line 23.

Second

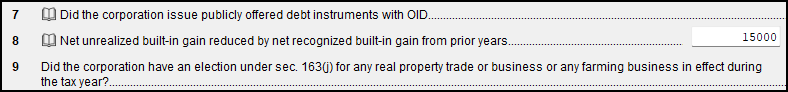

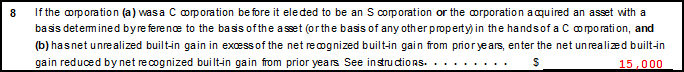

Complete line 8 on the B screen (Other Information). If an entry is not made here, the calculation needed in Part III of Schedule D is not completed. This figure is necessary to line 18 of Part III of Schedule D.

That figure shows up on page 2 of Form 1120-S.

If this figure is less than the figures on lines 16 and 17 of Part III Schedule D, it will be the figure that flows to line 18 and used to complete the calculation.

When data entry is finished, line 22b (and 22c) will populate on page 1 of Form 1120-S.

For more information on built-in gains and how to report them, see the IRS instructions for:

-

Schedule B: 1120-S Instructions.

-

Schedule D: 1120-S Schedule D Instructions.