Drake Accounting - Federal Tax Options

Article #: 15789

Last Updated: December 05, 2024

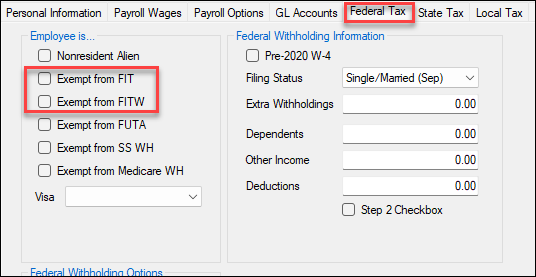

You are now able to indicate if an employee is exempt from Federal Income Tax (FIT) or Federal Income Tax Withheld (FITW). To select one of these options, go to Employees > Employee Setup > select the relevant employee > Federal Tax tab.

Exempt from FIT (Federal Income Tax)

-

The employee’s wages and withholding are exempt from federal income tax.

-

This means no taxes are taken out of checks for federal income tax.

-

Wages will not show up on box 1 of the W-2 or box 2 of the 941.

-

Withholding will not show up in box 2 of the W-2 or box 3 of the 941.

Exempt from FITW (Federal Income Tax Withheld)

-

The employee is exempt from federal income tax withholding.

-

However, the employee is not exempt from the taxes themselves.

-

Wages will show up in box 1 of the W-2 or box 2 of the 941.

-

Withholding will not show up in box 2 of the W-2 or box 3 of the 941.

Important Selecting these options will affect the amounts in box 2 (federal wages) and box 3 (income tax withheld) for the 941.