Drake Accounting - Additional Payroll Options

Article #: 16482

Last Updated: December 05, 2024

Under Employees > Payroll > Live or ATF, there are additional payroll options from which to choose:

-

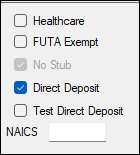

Healthcare

-

Select this option if the employee has healthcare.

-

-

FUTA Exempt

-

Select this option to avoid adding the payment amount for this check to payroll for FUTA purposes.

-

-

Mark Printed

-

This field indicates whether the paycheck should print for the employee.

-

Live Payroll

-

When Mark Printed is selected, Drake Accounting recognizes this particular check as having been printed even though it has been entered in Live Payroll.

-

The check will not appear as a check to print under Employees > Check Print.

-

This field changes to the No Stub option (see below) for direct deposit employees.

-

-

ATF Payroll

-

The Mark Printed field is selected for non-direct deposit employees, and editing cannot take place.

-

ATF checks do not appear as checks to print under Employees > Check Print.

-

This field changes to the No Stub option for direct deposit employees.

-

-

-

-

No Stub

-

Live Payroll

-

When selected, this option indicates that no check stub should print for the selected direct deposit pay.

-

A Check Date must be entered on the Live Payroll screen.

-

When this option is selected, no print record displays in Employees > Check Print.

-

The pay information automatically posts to the journal.

-

This field changes to Mark Printed option for employees not set up for direct deposit.

-

-

-

ATF Payroll

-

ATF stubs do not appear as stubs to print under Employees > Check Print but can be printed by selecting Reprint checks.

-

The pay information automatically posts to the journal when the payment information is saved.

-

The No Stub field changes to the Mark Printed option for non-direct deposit employees.

-

-

-

Direct Deposit

-

This option indicates that the check will be direct deposited based on information under Employee Setup.

-

This allows you to designate if an employee will have direct deposit for that check or not (who has direct deposit set up).

-

If you uncheck it, the employee will not be direct deposit for that check and will have a paper check.

-

-

Test Direct Deposit

-

Select this option to create a "test check" Direct Deposit file for the selected employee that can transmit to Kotapay.

-

When this option is selected, all amounts on the check change to zeros.

-

A test transmission file occurs when the test check is generated.

-

-

Create a separate test transmission file for each employee.

-

-

NAICS

-

Some states use the North American Industry Classification System (NAICS) to collect and analyze statistical data related to their economy.

-

These codes identify the type, or class, of work the employee does. Enter the employee's NAICS code, if applicable.

-

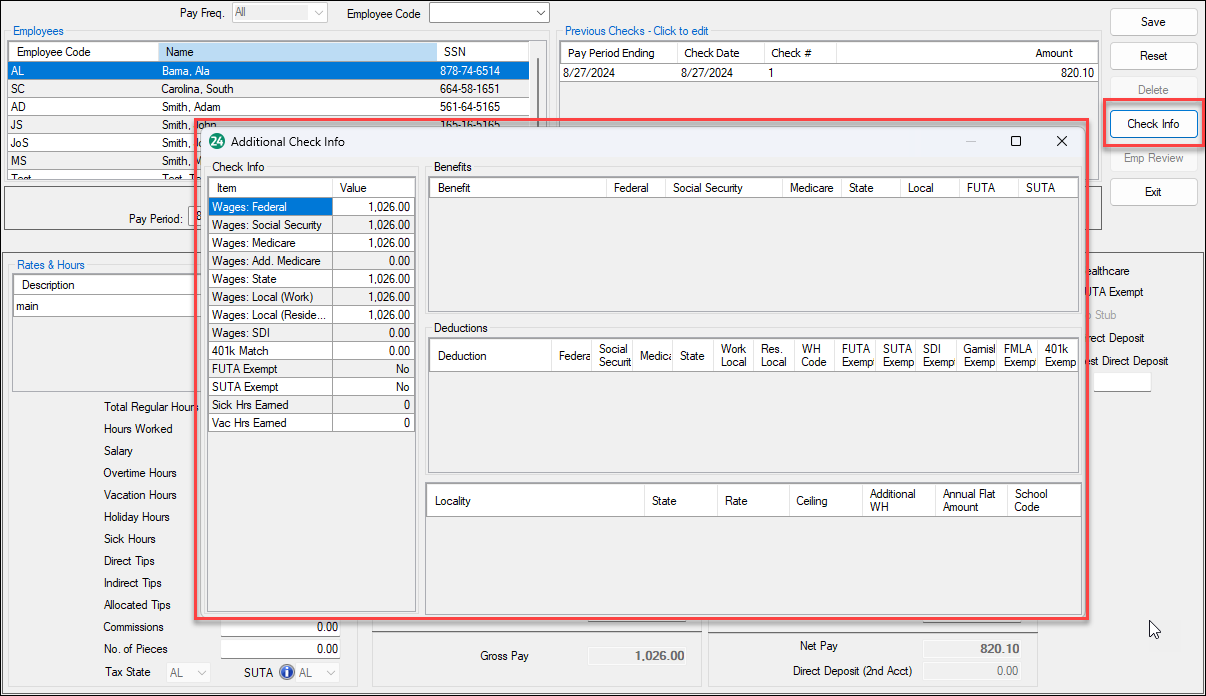

Verify the information on the check by clicking the Check Info button in the upper right corner of the screen. This button displays a read-only additional check information window that shows the check's wages, accrued hours, benefit and deduction information, and more.