Drake Tax - 5227: Distributions

Article #: 13818

Last Updated: December 05, 2024

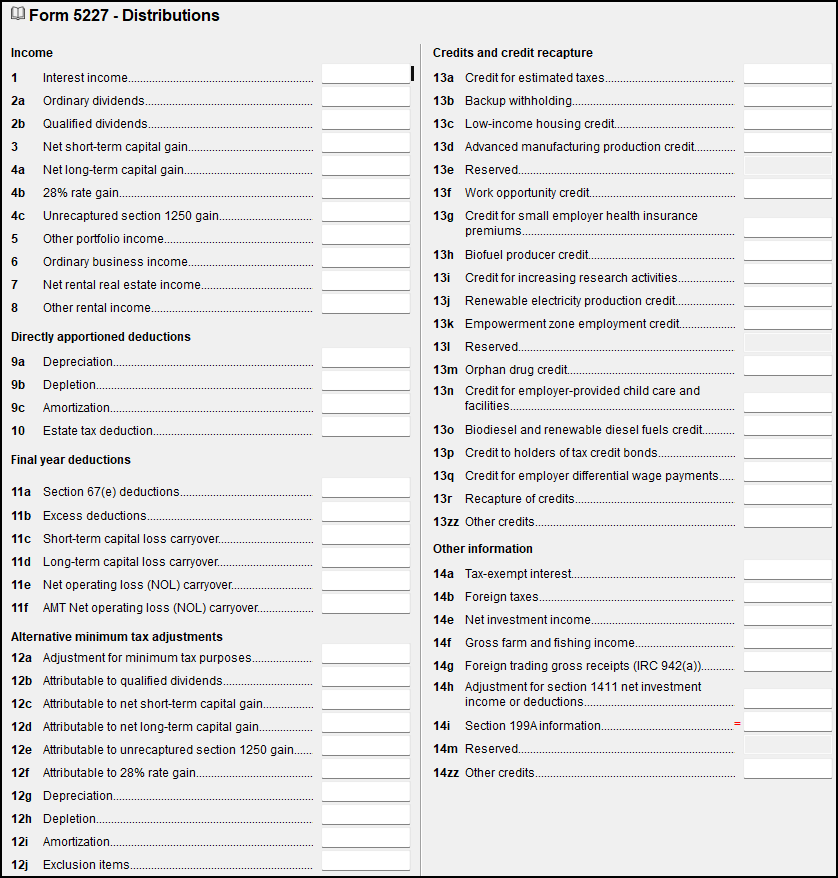

You can use the DIST screen for 5227 split-interest trust filers. The DIST screen can be used to produce the results desired on beneficiary K-1s for split-interest trust beneficiaries and resolves problems associated with returns that include prior-year accumulated income.

In View/Print mode, the DIST screen produces

-

a Form 5227_K1 for each beneficiary, based on DIST screen entries.

-

and a Wks 5227 K1 that displays the DIST screen entries (the total of amounts that flow to the individual Form 5227_K-1s).

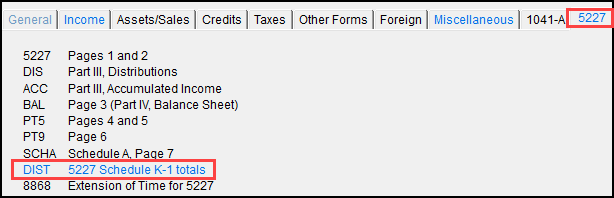

To open the DIST screen, click the DIST link on the 5227 tab in the Data Entry Menu.

Enter total amounts for all beneficiaries in each field. The amounts are allocated to each beneficiary based on the percentage entered on the Fed % field on the federal K1 screen. (Part 1 of the 5227 SCHA screen also must be completed to produce the Form 5227_K1 and Wks 5227 K1.)