Drake Tax - K-1 Sorting and Viewing

Article #: 14265

Last Updated: December 05, 2024

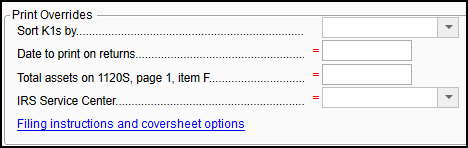

The default order of Schedules K-1 in View/Print mode is determined by the order in which the partners, beneficiaries, or shareholders are entered on the K1 screens. There are several sorting options available for Schedules K-1 in business returns. You can sort the list of Schedules K-1 by Recipient Name, ID number, Ownership Percentage, or a Control Number. The Sort K-1s by drop list is available on the PRNT screen inside a business return:

There are four ways in which Schedules K-1 can be sorted:

-

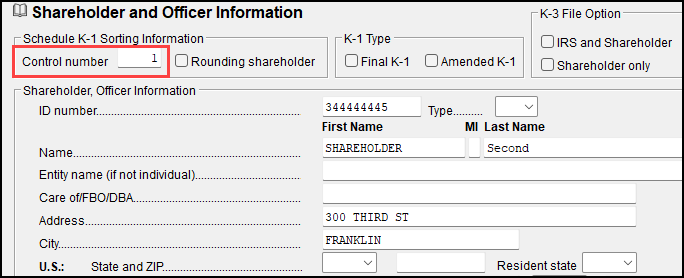

Control Number - This is a new entry available on K-1 screens starting in Drake Tax 2016. This field is a direct entry field that is not populated by the software. It is used to uniquely identify the partner, beneficiary, or shareholder. The number entered can be up to 5 digits in length and decimals are allowed. A control number column has been added to grid entry as well.

-

ID - Sort the partners, shareholders, or beneficiaries numerically by the SSN or EIN.

-

Name - Sort the partners, shareholders, or beneficiaries alphabetically by the first or last name of an individual, or the first word of a business name.

-

Percentage - Sort the partners, shareholders, or beneficiaries by their ownership percentage.

The list of Schedules K-1 in printed reports and worksheets will also display in the selected sort order.

Viewing Schedules K-1

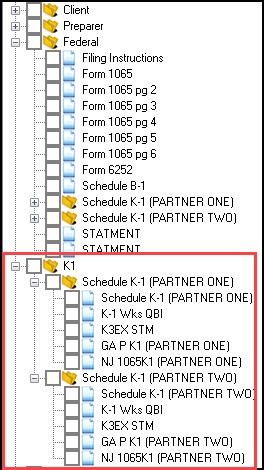

On the All Forms tab, you will see the shareholder/partner's name next to the K1 form name. Additionally when you go to the Sets tab, under the K1 set, each shareholder/partner has their own folder showing all federal and state Schedules K-1.

See the video https://support.drakesoftware.com/Video/viewing-k1s for more information.