Drake Tax - 1040 - Distributions in Excess of Basis from 1065

Article #: 16510

Last Updated: October 14, 2025

Note For tax purposes, a decrease in a partner’s share of partnership liability (debt) is treated the same as a cash distribution by the partnership as discussed above.

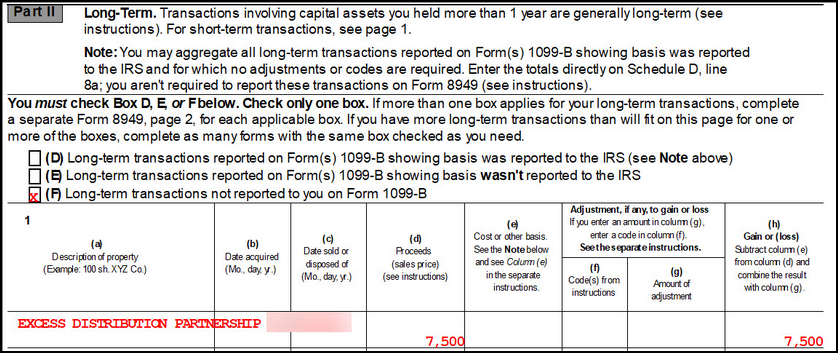

Review Form 8949, Part II. Box F is checked and the description shows as Excess Distribution with the name and EIN of the partnership listed:

See Publication 541 and the Tax Information for Partnerships for details.

In prior years, the gain is not automatically computed (see note 216). Manual entries on screen D and the basis worksheet screen were required.