Drake Tax - OR - Working Family Household and Dependent Care (WFHDC)

Article #: 14912

Last Updated: December 05, 2024

The Working Family Household and Dependent Care (WFHDC) credit is a refundable credit available to low to moderate income families who paid for dependent care during the year for one or more qualifying individuals.

Within Drake Tax, the Schedule WFHDC for the Working Family Household and Dependent Care (WFHDC) credit is populated using the information entered on the federal 2441 - Child Care Credit screen. If the state information differs from the federal 2441, within the OR data entry, edits can be made to the WFC (for provider information) and WFC2 (for qualifying individuals) screens.

If Schedule WFHDC is not producing in the View/Print mode, ensure that if a married filing jointly (MFJ) return, that neither spouse has negative income and hasn’t indicated that he or she is in school or disabled. Both of these factors will keep this schedule from producing.

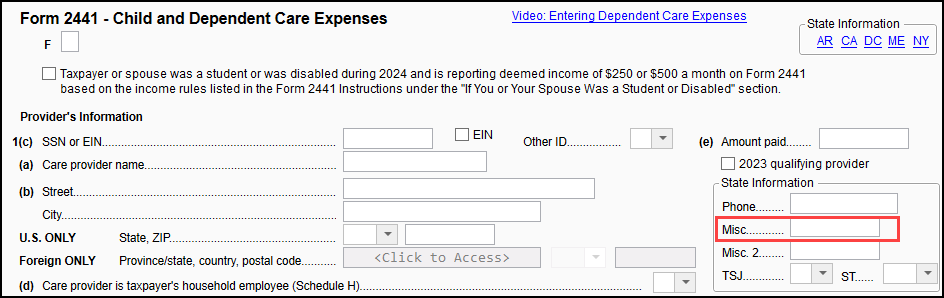

In addition to the previously mentioned requirements, EF Messages 0037 or 0048 can produce if a relationship code has not been entered on the federal 2441 screen. To clear these messages, return to data entry of the 2441 screen and in the MISC box to the right of the screen, enter one of the Child-to-Provider codes shown below. Once a Child-to-Provider code has been entered, the red messages should be cleared.

Oregon Child-to-Provider relationship codes:

SD - SON/DAUGHTER

SC - STEP CHILD

FC - FOSTER CHILD

SB - BROTHER/SISTER

PT - PARENT

SP - SPOUSE

GP - GRANDPARENT

GC - GRANDCHILD

AU - AUNT/UNCLE

NN - NIECE/NEPHEW

OR - Other relative

NR - Other nonrelative

To clear EF Message 0060, verify that the amount paid for childcare is accurately entered for each dependent. If there was no amount paid, do not enter 0 (leave the field blank instead).

For income limitations or more information on the Oregon Working Family Household and Dependent Care (WFHDC) credit, see Publication OR-17.