Drake Tax - OR - Form OR-OC Composite Return

Article #: 17808

Last Updated: December 05, 2024

Per the instructions, "Pass-through entities (PTEs) with distributive income attributable to Oregon sources must file a composite return on behalf of their nonresident owners who elect to participate in the composite filing. The PTE reports the nonresident owners’ share of Oregon-source distributive income on one tax return, Form OR-OC."

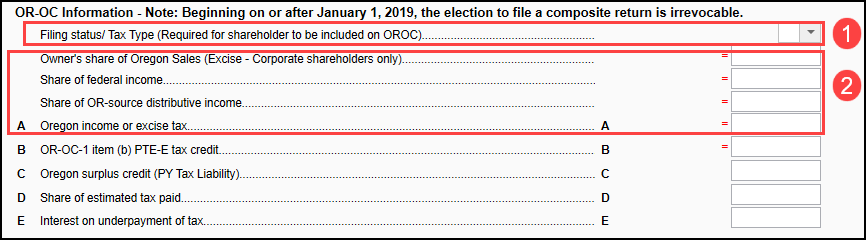

To elect to include a partner or shareholder on the Oregon composite return, and generate Form OR-OC, go to OR data entry and on the OC Composite Return tab, open the OC1 screen for each shareholder/partner who should be included on Form OR-OC. Near the bottom of the screen, make a selection in the drop box A Filing Status/Tax Type. Selections include:

I - Income (Corporate)

E - Excise (Corporate)

T - Trust

S - Estate

1 - Single (Individual)

2 - Married Filing Joint (Individual)

3 - Married Filing Separate (Individual)

4 - Head of Household (Individual)

5 - Qualified Widow (Individual)

At least one partner or shareholder must be included, or Form OR-OC will not be generated in the view mode. Note: Beginning on or after January 1, 2019, the election to file a composite return is irrevocable.

Make any other entries as needed to accurately complete the form. If any K-1 override amount is entered for one participating nonresident member, partner, or shareholder, then the same override item (corresponding line) must be manually entered for all participating members.