Drake Tax - 1040 - Section 962 Election

Article #: 16902

Last Updated: December 05, 2024

A Section 962 election is an election made by a domestic shareholder of a controlled foreign corporation to be taxed at corporate rates. Notice 2018-26 explains that:

"...section 962 provides that an individual who is a United States shareholder may elect to have the tax imposed under chapter 1 on amounts that are included in the individual’s gross income under section 951(a) be an amount equal to the tax that would be imposed under section 11 if the amounts were received by a domestic corporation."

To make a Section 962 election for the Section 965 tax, follow these steps:

-

On screen 5, line 16(3) Section 962 Election, enter the amount of tax due to making a Section 962 election (as a positive number) for taxpayer or spouse, as applicable. (In Drake19 and prior, the entry is made on line 12a(3) of screen 5)

-

On the SCH screen:

-

Choose either T, S, or J in the TSJ box.

-

Select 018 (029 in Drake19 in prior) in the Type of attachment/statement number and title drop list.

-

In the larger white box, enter a statement detailing the election being made that also shows how the taxpayer computed the tax.

-

-

In View/Print mode,

-

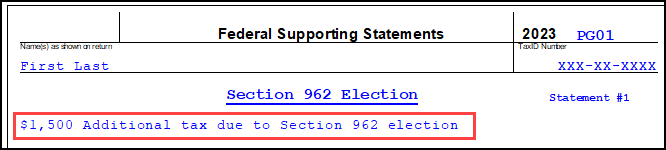

Statement 01 is produced with the description from the SCH screen.

-

The Tax Computation page produces to show a breakdown of the tax amount shown on Form 1040, line 12b including the Additional tax due to section 962 Election tax computation reported on Form 1040, line 12a, box 3.

-

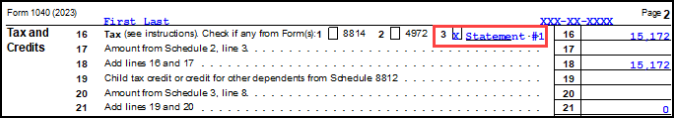

Form 1040, line 12a, has box 3 marked with the amount and Statement #1 entered as the description.

-

When the GILTI income amount from Form 8992 is included in "other income" (Form 1040, Schedule 1, line 8), and you are electing to tax the amount at the corporate rate with the Section 962 Election, you will need to make an offsetting entry on Screen 4, line 24z. Enter “Section 962 Election” as the description and the GILTI income as a positive amount in that field.