Drake Tax - Creating a Beneficial Ownership Information (BOI) Report

Article #: 18339

Last Updated: December 05, 2024

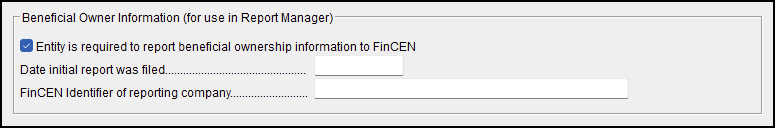

New report keywords have been added to the Report Manager for Drake Tax 2023, allowing you to easily view a list of taxpayers and entities who have filed BOI reports with FinCEN. In order for BOI information to appear on these reports, at least one of the following BOI fields must be completed on screen MISC (Miscellaneous Codes/Notes) of the return.

Go to Tools > Blank Forms, to locate a two page checklist “BOIR” and “BOIR Pg 2” that can be printed and given to a taxpayer to assist them in gathering the necessary information for completing the filing requirements of a Beneficial Owner.

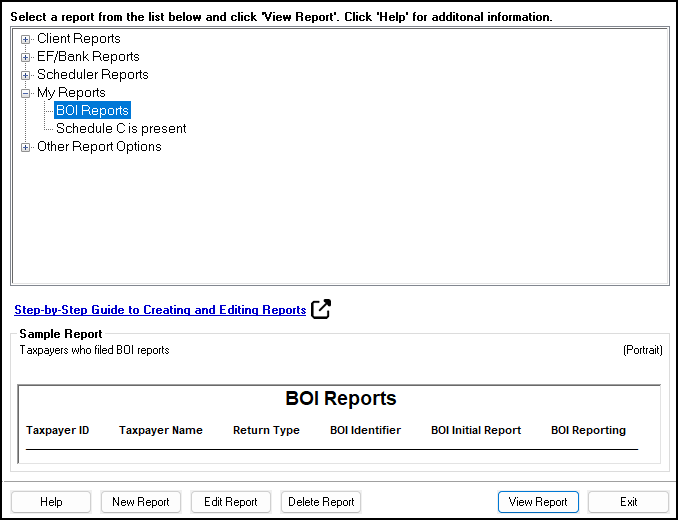

The Report Manager window allows you to create a new report or edit an existing report. You can also modify the report layout and define filters. To access the Report Manager, from the Drake Tax Home menu bar, select Reports > Report Manager.

Build a BOI Report

-

From the Report Manager window, click New Report.

-

Choose the report type Tax return data. Click OK to open the Report Editor - Step 1 window.

-

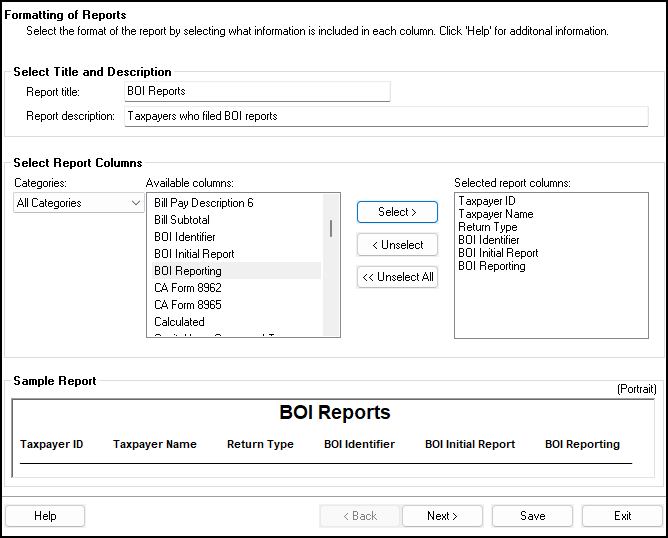

Add a BOI Report title and Report description.

-

Use the Select Report Columns section to choose the data to include in the report. The Categories drop list determines what data you can select from the Available columns list. Drake Software recommends adding the following columns for BOI reports:

-

Taxpayer ID

-

Taxpayer Name

-

Return Type

-

BOI Reporting

-

BOI Initial Reporting

-

BOI Identifier

-

-

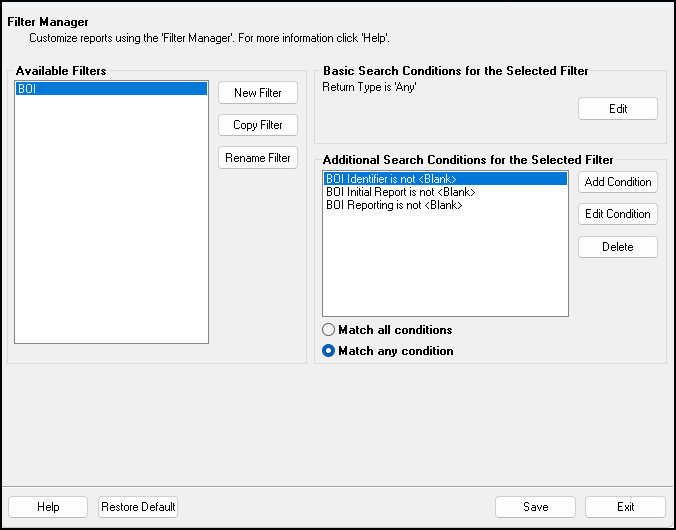

Click Next to open the Step 2 window. Beside the Select a report filter drop list, click Edit Filters. The Filter Manager is opened.

-

In the Available Filters section, create a New Filter for BOI reports. Enter a filter name and click OK.

-

With the new filter highlighted in the Available Filters section, choose Add condition.

-

Choose one of the applicable keywords (BOI Reporting, BOI Initial Reporting, or BOI Identifier), and from the Comparison drop list, choose is not <Blank>. Click OK to save the condition. The new condition appears in the Additional Search Conditions for the Selected Filter section.

-

Repeat steps 7 and 8 until all BOI keywords are present in the Additional Search Conditions for the Selected Filter section.

-

Under Additional Search Conditions for the Selected Filter, choose Match any condition.

-

Click Save. The Report Editor is closed, and your new report is saved under My Reports. If data is entered for any of the three applicable fields on screen MISC, the taxpayer appears when you run the report.

See Drake Tax - Corporate Transparency Act - Beneficial Ownership Information for more information about filing the BOI report through the FinCEN website.