Drake Tax - NC - Bailey Settlement

Article #: 16985

Last Updated: December 05, 2024

Per NC Individual Instructions:

As a result of the North Carolina Supreme Court’s decision in Bailey v. State of North Carolina, North Carolina may not tax certain retirement benefits received by retirees (or by beneficiaries of retirees) of the state of North Carolina and its local governments or by United States government retirees (including military)...

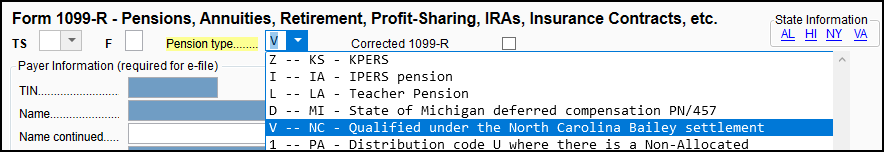

If you determine that the return qualifies, you can go to the federal 1099 screen in data entry, then select V -- NC - Qualified under the North Carolina Bailey settlement in the Pension Type field. This will treat the income as tax-free under the NC Bailey Settlement. Even though this is entered on the federal 1099 screen, the Bailey Settlement selection only affects the North Carolina state return.

For more information on the Bailey Settlement, see NC Individual Instructions page 18.