Drake Tax - 1040: Recapturing Depreciation

Article #: 11565

Last Updated: December 05, 2024

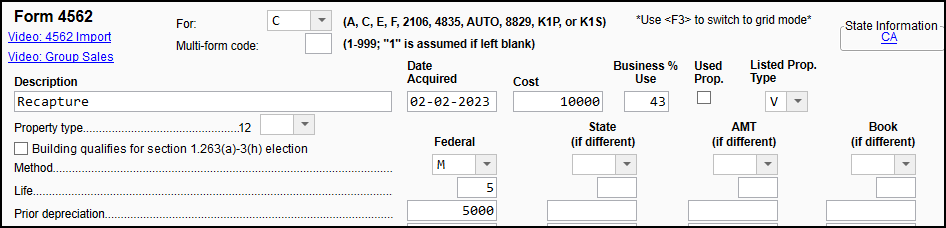

To recapture depreciation on an asset, verify the entries on the 4562 detail screen for the asset requiring recapture.

The example above is of a typical asset with less than 50% business use and depreciation to be recaptured. Note the change in business use entered (dropped to 43%).

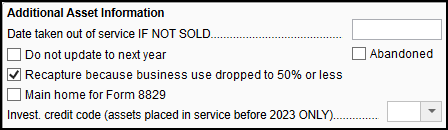

Select Recapture because business use dropped to 50% or less under the Other Information section.

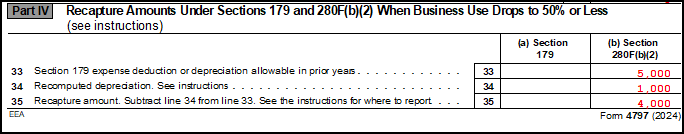

View the return. Review Form 4797 Part IV, Recapture Amounts Under Sections 179 and 280F(b)(2) When Business Use Drops to 50% or Less. Depending on the depreciation involved, amounts will display under column (a), Section 179 and/or column (b), Section 280F(b)(2).

If there is recapture assessed it will display as Other income on the schedule to which the asset belongs. For example, if the asset is pointed to Schedule C, any recapture will display on line 6.

If the recapture is not produced:

-

Verify the 4562 screen is pointed to a valid schedule with the correct multiform code.

-

Verify there is depreciation that must be recaptured.

-

Verify the business use percentage is not higher than 50%.

-

Verify the correct method is chosen.

-

Verify that the If Sold section has not been completed for the asset.

-

Part IV is for assets that have not been sold, but the business use for which has dropped to 50% or less. This is typically a situation that occurs when you still own assets for a business that no longer exists. When you enter the sale of an asset on Form 4797, the software calculates your gain from the sale. That calculation includes consideration of your prior depreciation as part of the basis of the asset sold. That includes consideration of Section 179 expense. If the sale results in a gain, the gain is taxable income. Thus, in a sale, there is no need to report information from the sale on Part IV for recapture, because the mechanics of the sale make recapture unnecessary.

-

Part IV information can be entered directly on screen 4797. It also can flow from screen 4562, when the box is checked for Recapture because business use dropped to 50% or less.

For more information about recapturing depreciation, refer to Publication 946 How to Depreciate Property.