Drake Tax - 4562: Sale of One Asset from Group of Assets

Article #: 13228

Last Updated: December 05, 2024

When you have a grouping of assets included on one 4562 screen and the taxpayer sells one of those assets, the asset must be separated from the group entry. The cost and prior depreciation of the original entry should be adjusted to reflect this change. A new 4562 screen should be created for the asset sold. Reflect the sale in the If Sold section.

Example:

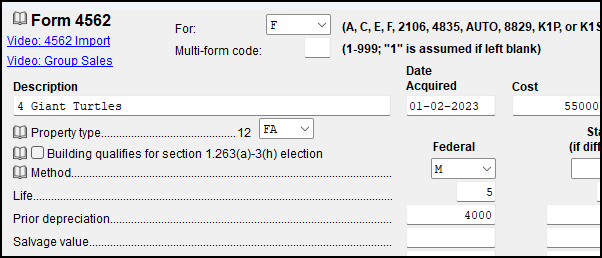

A taxpayer raises turtles on his farm. The taxpayer originally purchased four giant turtles, and entered them on one 4562 screen:

The taxpayer sells one of the turtles to a local zoo. The cost and portion of depreciation must be taken into account for the original asset of four giant turtles.

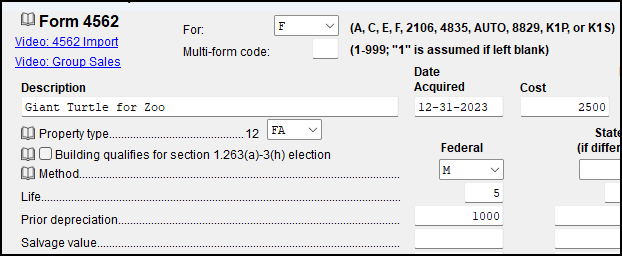

A new 4562 must be created for the turtle that was sold, including the apportioned cost and prior depreciation.

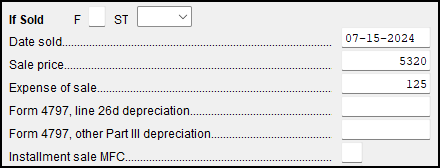

The information relating to the sale may be included in the If Sold section of the 4562 screen (on the bottom right).