Drake Tax - NJ - Signed Statement for Erroneous Withholding From PA Resident

Article #: 13525

Last Updated: December 05, 2024

Under a reciprocal agreement, Pennsylvania residents who receive compensation from New Jersey sources are not subject to New Jersey income tax on those earnings. NJ Income Tax - PA/NJ Reciprocal Income Tax Agreement. This agreement covers compensation only - salaries, wages, tips, fees, commissions, bonuses, and other remuneration received for services rendered as an employee.

A taxpayer who is a Pennsylvania resident, whose employer withheld New Jersey income tax from wages, must file a New Jersey nonresident return to obtain a refund. When filing for a refund, Pennsylvania residents must enclose a signed statement with their New Jersey nonresident income tax returns declaring that they are residents of the Commonwealth of Pennsylvania.

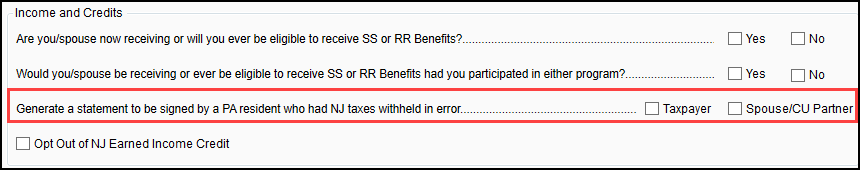

Drake Tax will produce the statement (NJ_PASTM). Select the option at the bottom of NJ screen 1, Generate a statement to be signed by a Pennsylvania resident who had New Jersey taxes withheld in error.