Drake Tax - NJ - Veteran Exemption

Article #: 15400

Last Updated: December 05, 2024

New Jersey allows an additional exemption for certain military veterans who were honorably discharged or released under honorable circumstances from active duty in the Armed Forces of the United States by the last day of the tax year. Per the NJ 1040 Instructions, page 6:

"Beginning with tax year 2019, the veteran exemption increased to $6,000. You can claim this exemption if you are a military veteran who was honorably discharged or released under honorable circumstances from active duty any time before the last day of the tax year. If you are filing jointly, your spouse can also take this exemption if they are a military veteran who meets the requirements. You cannot claim this exemption for your domestic partner or dependents."

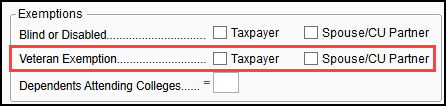

To claim the exemption in Drake, go to the NJ data entry > Screen 1 General Information. In the Exemptions section, check the box Taxpayer and/or Spouse/CU Partner beside Veteran Exemption, as applicable.

The Veteran exemption shows on the NJ 1040 or 1040NR, line 9. The Veteran exemption(s), along with any other exemptions claimed on the return, are calculated on NJ WK_EXM and then the Total Exemption Amount flows to the NJ 1040, page 2, line 13 or the NJ 1040NR, page 2, line 31.

Note: The Veteran Income Tax Exemption Submission Form and Form DD-214 Certificate of Release or Discharge from Active Duty are not available in Drake Tax. These forms must be filed by the taxpayer and/or spouse with the NJ DOR prior to filing the tax return. The NJ DOR provides guidelines for submitting these documents securely online through their website, by mail, or by fax. If paper-filing the NJ return, the documentation may be enclosed with the return.