Drake Tax - NJ - New Jersey Earned Income Tax Credit (NJEITC)

Article #: 18064

Last Updated: December 05, 2024

Generally, New Jersey Earned Income Tax Credit (NJEITC) follows federal EIC requirements and is calculated as 40% of the federal EIC amount.

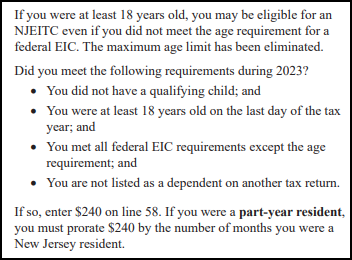

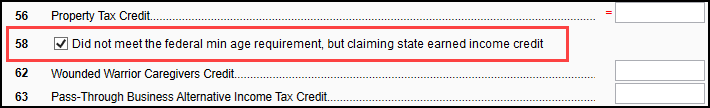

NJ has an exception for taxpayers who would qualify for federal EIC except for the age requirement. If a taxpayer meets all of the other requirements except for age, you can indicate this by going to NJ > screen 2 > line 58 and checking the box:

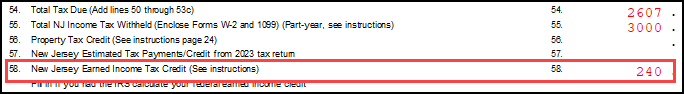

This will calculate $240 for the NJ EIC.

For more information, see the NJ Instructions for line 58.