Drake Tax - MO - Missouri Income Percentage, Form MO-NRI

Article #: 14832

Last Updated: December 05, 2024

If MO is listed as the resident state on federal screen 1, then the Missouri income percentage will always be 100%. For the income percentage calculated on Form MO-NRI to flow to the MO 1040, the resident state selection on federal screen 1 has to be either PY, or a state other than Missouri.

MO screen NRI has two main parts, Part A and Part B.

For Part A, only the applicable section (Part A1, A2, or A3) should be completed by the taxpayer and/or spouse.

A nonresident of MO will complete Part A1, line 1.

A part-year resident of MO will complete Part A2, lines 2a and 2b.

A nonresident member of the military will complete Part A3, either line 3a or line 3b.

Part B is the Worksheet for Missouri Source Income.

The amounts for the income items listed generate based upon the state selection on the data entry screens for the income items.

Overrides (=) and adjustment fields (+/-) are provided for any needed changes.

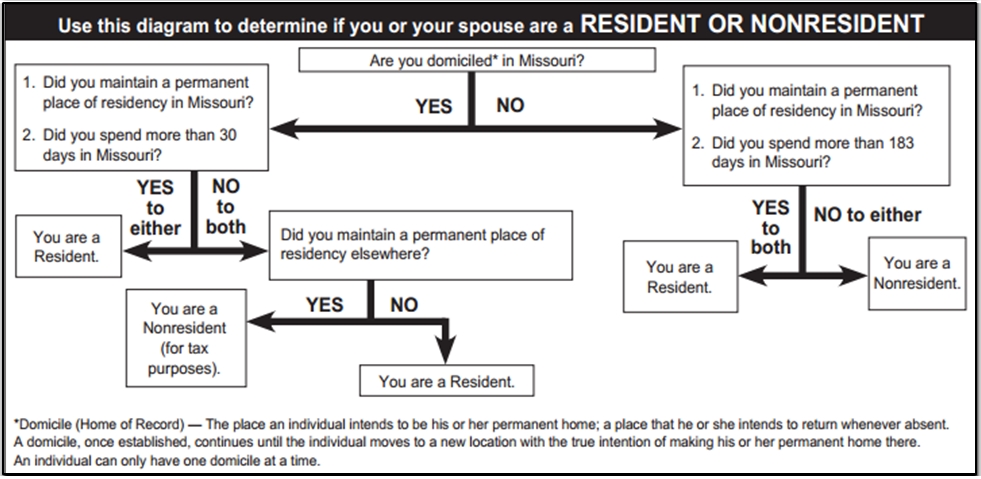

The Resident or Non-Resident decision table from the Form MO-NRI Instructions can be used to help determine residency status: