Drake Tax - WI: Tuition Expenses

Article #: 14923

Last Updated: December 31, 2025

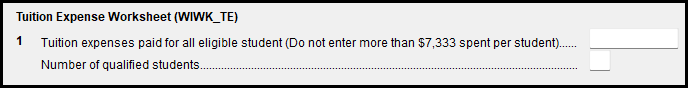

Note Per the 2024 Wisconsin Form 1 Instructions: The subtraction for tuition and fees has increased to $7,333 per student starting in 2024. The phase-out range has changed. See the Schedule SB instructions.

If you enter an amount in excess of $7,333 per student, EF Message 0142 will generate alerting you to this limitation. The software will not limit the amount for you; you must enter only the allowable amounts based on the taxpayer's situation.

Given the entries on screen 3, the program will compute the tuition subtraction and carry it to the WISB, line 8. The total subtractions will then flow through to the WI 1, page 1, line 4. If the deduction is limited, the WI WK_TE will produce.

Note If you would like the worksheet to produce, even if not required, go to the WI OPT screen and check the box Tuition worksheet (WI WK_TE) to force the worksheets to print.

Only enter the tuition and mandatory student fees paid to a Wisconsin university, college, technical college, or other approved post- secondary school or a Minnesota public institution that qualifies under the Minnesota-Wisconsin tuition reciprocity agreement. An amount up to $7,333 per student is allowed.

If there is a tuition and fees deduction on the federal return, this amount must be added back on Schedule I. It is not allowed for Wisconsin purposes.