Drake Tax - Schedule C: Taxpayer Disposed of Business

Article #: 14104

Last Updated: December 05, 2024

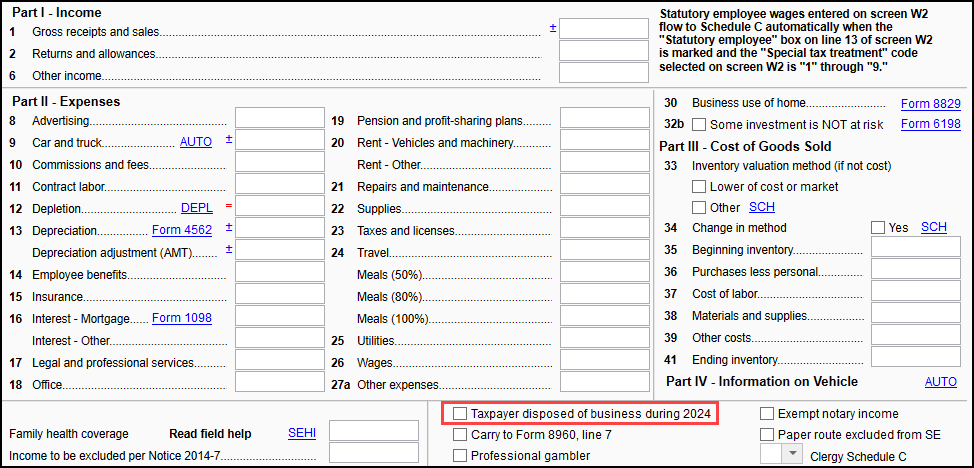

If the taxpayer has closed or disposed of their business during the tax year, you can indicate this on the Income tab > C screen of data entry. On this screen, select theTaxpayer disposed of business during 2025 check box.

Checking this box does not have an impact on the current year Schedule C calculation, but it will prevent the Schedule C from updating to the next tax year when the client's return is updated within Drake Tax.