Drake Tax - Schedule E: Disposition of Rental Property

Article #: 14249

Last Updated: November 03, 2025

If a rental property has been sold, you will need to indicate this within data entry of the tax return. To access the Schedule E data entry screen, go to the Income tab > E - Rent and Royalty Income screen. On the right side of this screen, there is a check box that says Property was disposed of in 20YY (where YY is the current tax year). If this box is marked, the system will automatically determine whether the property was disposed of at an overall loss or an overall gain and carry the gain or loss to the Schedule 1 line 5.

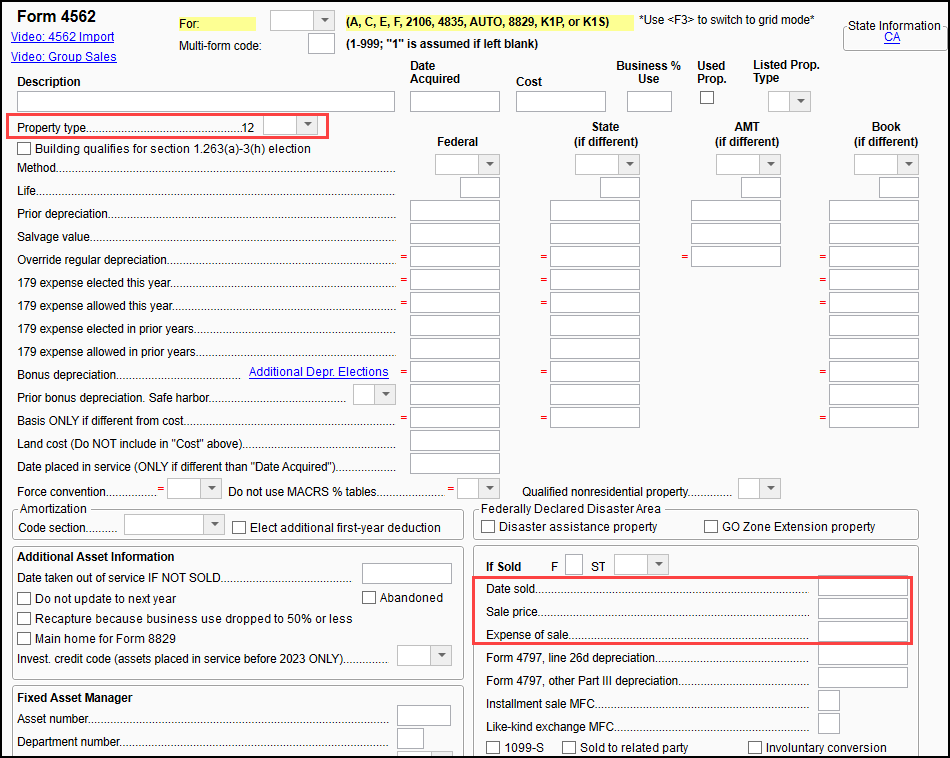

If there are depreciable items that were associated with this rental property, the If Sold section of the 4562 Depreciation Detail screen may also need to be completed. Entering only a Date Sold will stop depreciation and keep the asset from updating to the next tax year. If a Form 4797, Sale of Business Property, is also needed, a Property Type, Sales Price and any applicable Expense of sale should also be entered.

The Property Type is located in the top left corner of the 4562 screen under description, while all other previously mentioned fields are located in the bottom right corner of the screen.

For more information, see the Schedule E instructions.