Drake Tax - Schedule E: Activity Type, Section 179, Note 120

Article #: 18104

Last Updated: November 03, 2025

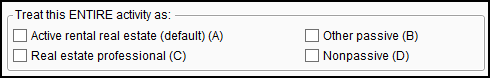

There are four options available on screen E for "Treat this ENTIRE activity as":

Choose the applicable rental activity type to automatically apply applicable IRS limitations. If no option is selected, the program defaults to option A.

-

A - Active rental real estate

-

B - Other passive (activity)

-

C - Real estate professional

-

D - Nonpassive (not a passive activity)

Generally, Schedule E is used for passive activities. Per IRS Publication 527:

"In most cases, all rental real estate activities (except those of certain real estate professionals...) are passive activities. ... If you qualify as a real estate professional, rental real estate activities in which you materially participated aren’t passive activities."

Activity types A and B are considered passive activities and are subject to passive activity limitations. Certain deductions, such as section 179, are not allowed, and the taxpayer cannot deduct passive activity expenses against income not from a passive activity. See Drake Tax - Basis, At-Risk, and Passive Activity Limits for more information.

Activity type C, "Real estate professional," is not a passive activity. Per IRS Publication 527, the taxpayer qualifies as a real estate professional only if they meet both of the following conditions:

-

More than half of the personal services performed in trades or businesses during the tax year are performed in real property trades or businesses in which the taxpayer materially participated

-

The taxpayer performed more than 750 hours of services during the tax year in real property trades or businesses in which they materially participated.

Return Note 120 is produced if an asset entered on screen 4562 (Depreciation Detail) was placed in service during the current tax year and is tied to a property on screen E, where any of the following is true on screen 4562:

-

EXP - Section 179 - expense whole amount is selected from the Method drop list.

-

An amount is entered for 179 expense elected this year.

-

An amount is entered for 179 expense elected in prior years.

Generally, as discussed above, a rental is a passive activity. Per the IRS code section 179, “For purposes of this section, the term 'section 179 property' means property… which is acquired by purchase for use in the active conduct of a trade or business.” If screen E has an activity type of C, it is not considered a passive activity, though it and may be eligible for a 179 deduction (reported on screen 4562). Review the Section 179 Business Income Limit worksheet ("DEPR - Wks 179 Limit") in View/Print mode for details. Section 179 expense cannot be claimed for any other activity type. Review Schedule E, Form 4562, and applicable worksheets to ensure that amounts are being calculated as expected.

Refer to the following IRS documents for more information: