Drake Tax - 1040: Generating the SEP Worksheet

Article #: 13160

Last Updated: December 05, 2024

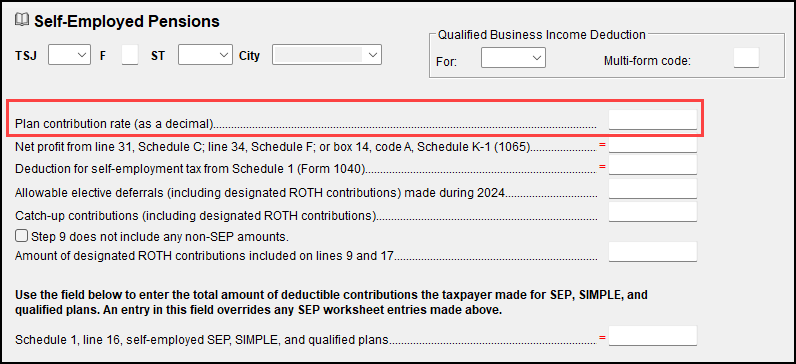

Tip If you want to override the total amount, use the override field at the bottom of the screen.

The deductible amount then flows to Form 1040:

-

Schedule 1, line 16 in Drake Tax 2021 and future

-

Schedule 1, line 15 in Drake Tax 2019 and Drake Tax 2020

Notes:

-

For a self-employed individual, contributions are limited to 25% of your net earnings from self-employment (not including contributions for yourself), up to:

-

$70,000 for 2025

-

$69,000 for 2024

-

$66,000 for 2023

-

$61,000 for 2022

-

$58,000 for 2021

-

$57,000 for 2020

-

-

To complete a separate Wks SEP for taxpayer/spouse (or for multiple businesses for a taxpayer), press Page Down to produce a new SEP screen and use the TSJ box to designate which data belongs to which taxpayer.

-

Select the relevant schedule (For box) and Multi-form Code in the Qualified Business Income section to tie the SEP screen to the applicable business.

-

-

SEP and QBI:

-

If there is only one business for each taxpayer, the QBI worksheet will show the same amount as Wks SEP for that taxpayer.

-

If there are multiple businesses, Wks SEP will show the total for each taxpayer and then the QBI worksheet will show only the amount figured for that business.

-

See Publication 560, Retirement Plans for Small Business, for more information regarding SEP contributions and deduction limits.