Drake Tax - Schedule E: Business Use Percentage Calculation

Article #: 16362

Last Updated: November 03, 2025

Drake Tax automatically calculates business use percentage for 1040 returns only. For business returns, the program assumes that the nondeductible personal use portion has been accounted for on the entity’s books and records and that the entries on the applicable screens are net from nondeductible expenses attributable to the business use of the rental property.

A rental may be used for both personal and business purposes throughout the year. Per Publication 527,

"A day of personal use of a dwelling unit is any day that the unit is used by any of the following persons.

-

You or any other person who owns an interest in it, unless you rent it to another owner as his or her main home under a shared equity financing agreement...

-

A member of your family or a member of the family of any other person who owns an interest in it, unless the family member uses the dwelling unit as his or her main home and pays a fair rental price. Family includes only your spouse, brothers and sisters, half brothers and half sisters, ancestors (parents, grandparents, etc.), and lineal descendants (children, grandchildren, etc.).

-

Anyone under an arrangement that lets you use some other dwelling unit.

-

Anyone at less than a fair rental price."

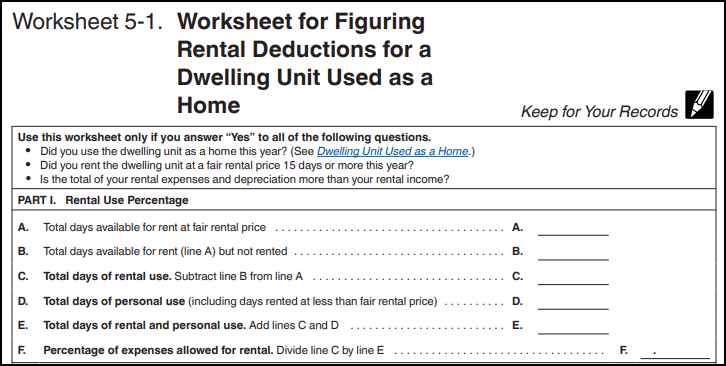

If this is the case, then your expenses may be limited. On the E screen, report the number of Fair rental days and the Personal use days on the Income/Expenses tab to allow Drake Tax to calculate the business use percentage. Per Publication 527, the business use percentage is calculated using the following worksheet.

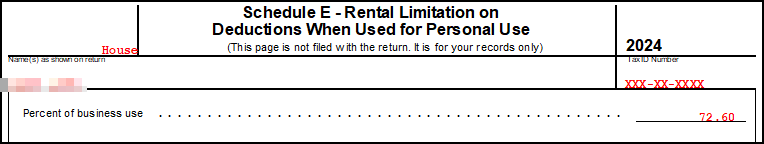

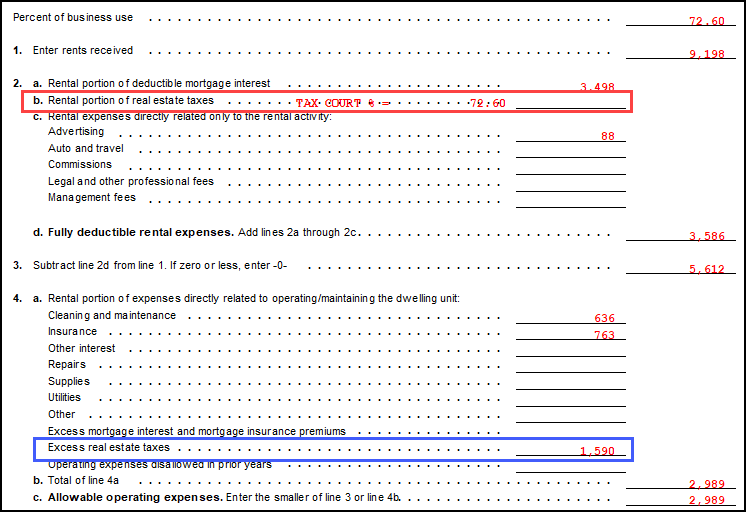

To calculate the business use percentage, you divide the total number of days the unit was actually rented out, by the total number of days that it was rented out and used for personal use. The calculated amount of the business use percentage flows to the Wks Sch E Personal in View Mode. This amount is used to calculate various lines on the worksheet.

Wks Sch E Personal will not show amounts on lines 2a, 2b, and 2c. The following is adapted from Publication 527:

-

Line 2a:

-

If you are claiming the standard deduction, do not report an amount on line 2a; instead, report the rental portion of your mortgage interest and mortgage insurance premiums on line 4b.

-

If you are itemizing your deductions on Schedule A, figure the amount of mortgage interest to include on line 2a by using the following steps.

-

-

Line 2b:

-

If you are claiming the standard deduction, do not report an amount on line 2b; instead, report the rental portion of your real estate taxes on line 4c.

-

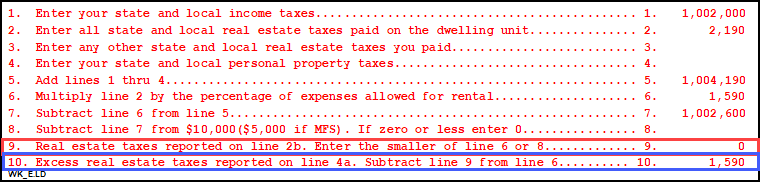

If you are itemizing your deductions on Schedule A, figure the amount to report on line 2b by using the following steps. Step 1. If the total of your state and local income (or, if elected on your Schedule A, general sales) taxes, real estate taxes, and personal property taxes is not more than $10,000 ($5,000 if married filing separately), enter the rental portion of the real estate taxes attributable to the dwelling unit you are renting on line 2b. Step 2. If you do not meet the condition of Step 1, use the following worksheet to figure the amount to include on line 2b.

-

-

Line 2c:

-

If you are claiming the standard deduction and you are not increasing your standard deduction by a net qualified disaster loss, do not report an amount on line 2c; instead, report the rental portion of your casualty losses on line 6a.

-

If you are itemizing your deductions on Schedule A or filing a Schedule A to increase your standard deduction by a net qualified disaster loss, figure the amount to report on line 2c by using the following steps.

-

The calculation for line 2b is done with an addendum at the bottom of Wks Sch E Personal in View/Print mode (referred to as the "Line 2b Worksheet" in Publication 527).

The results are then carried to the applicable line(s) at the top of the Wks Sch E Personal:

Loss Carryforward

If the total expenses exceed the total income, a loss may be generated. This loss cannot be used to offset income from another source. If the loss is not allowed in the current year, it will generate a carryforward to future year(s). The following worksheet(s) will generate in view mode to show the losses and any limitations:

-

Wks Sch E Personal

-

Wks Carry

-

Wks PAL

-

Form 8582 and the applicable worksheet(s): Wks 85821, Wks 85824, Wks 85825, Wks 85826

Not-for-Profit Rentals

Schedule E should generally only be used to report rental income from a property that is being rented in order to make a profit (whether or not a profit was realized). Per IRS Publication 527: "If you don’t rent your property to make a profit, you can’t deduct rental expenses in excess of the amount of your rental income. You can’t deduct a loss or carry forward to the next year any rental expenses that are more than your rental income for the year." The income from a not-for-profit rental is reported on Schedule 1, line 8. You may be able to deduct some expenses, up to the amount of that rental income, on Schedule A, if you choose to itemize deductions.

See Publication 527 for more information and assistance with determining whether or not the rental would be considered "for profit."