Drake Tax - 1040 - Schedule E - Tax Court Method Election

Article #: 15532

Last Updated: December 05, 2024

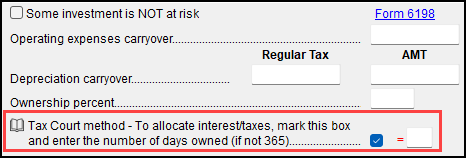

If the taxpayer would like to use the tax court method for interest and/or taxes allocation on a rental, check the box To use the Tax Court method to allocate interest and taxes... on the schedule E data entry screen:

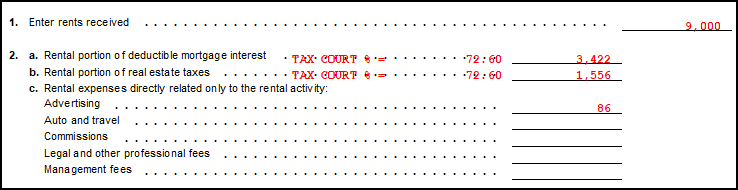

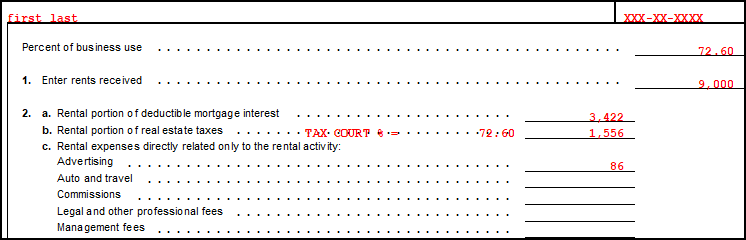

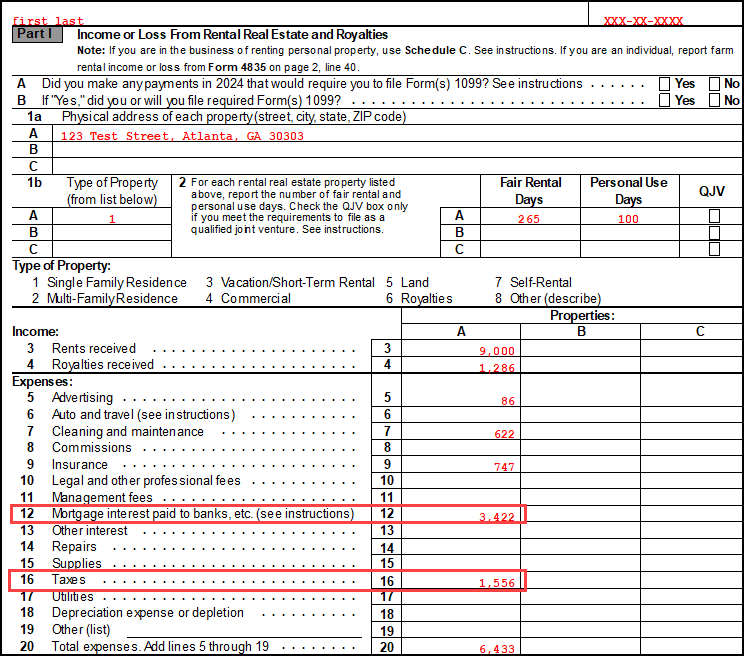

In the following example, the 1098 was entered with Mortgage Interest received of $5,500 and Real estate taxes paid of $2,500. On the Wks Sch E Personal worksheet, lines 2a (rental portion of deductible mortgage interest) and/or 2b (rental portion of real estate taxes) will be calculated using the tax court method instead of the IRS method. The tax court percentage is displayed beside each line with the result to carry to the Schedule E, lines 12 and 16, respectively.

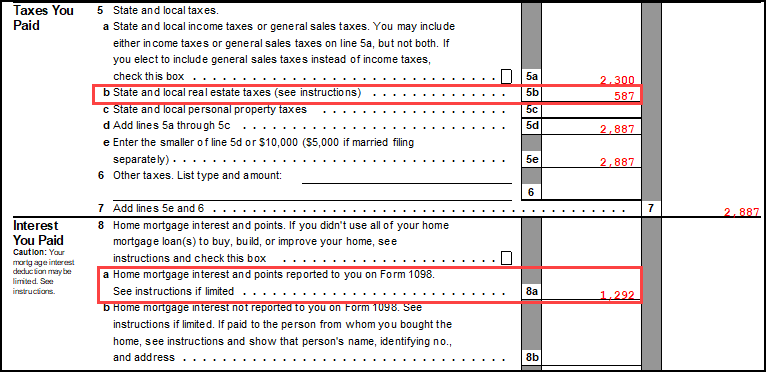

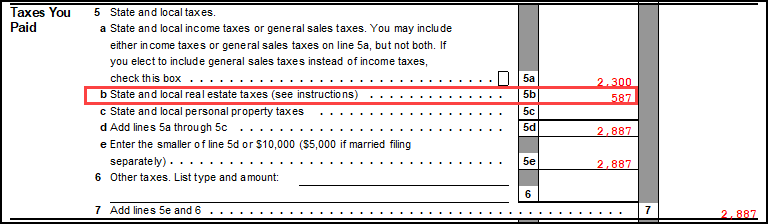

The remaining amount of real estate taxes will be carried to the Schedule A, line 5b:

Note The remaining amount of deductible mortgage interest will not be carried anywhere on the return if only the tax court method is chosen on the E screen.

In 2020, the IRS revised the worksheets used to calculate the rental deduction. See Publication 527, page 21 for details. The data entry and worksheets used in Drake20 are the same as in prior years, with the addition of the line 2b worksheet printed at the bottom of the Wks Schedule E Personal, if applicable.

If the rental was also the taxpayer's main or secondary home, however, the non-rental portion of the deductible mortgage interest may also be deductible on the Schedule A, line 8a. If this applies, the check box Taxpayer's main home or second home must also be marked for the software to carry the remaining amounts to the Schedule A. In this scenario on the Wks Sch E Personal worksheet, both lines 2a (rental portion of deductible mortgage interest) and 2b (rental portion of real estate taxes) will be calculated using the tax court method and all remaining deductible amounts carry to the Schedule A.