Drake Tax - PA - Asset Sale on Schedule C, D, or F

Article #: 15934

Last Updated: December 05, 2024

Business property sales create a taxable event for both federal and Pennsylvania Individual Tax purposes. For federal purposes, this transaction will first be reported on federal Form 4797, and then on either Form 1040, Schedule 1, line 4, or the federal Schedule D. For Pennsylvania purposes, this gain will be reported on either the Pennsylvania Schedule D or on a Pennsylvania business schedule. Whether a gain is reported as a capital or business gain depends on whether the sold asset will be replaced and used in the business. If the asset is not replaced by a similar asset, the asset is then reported on the Pennsylvania Schedule D. You can designate from the federal return whether or not an asset will be replaced by making a single entry on either of these Federal screens.

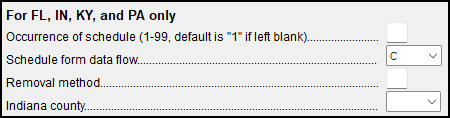

Specify the desired form within the Schedule form data flow drop down list.

-

C - carries to the Pennsylvania Schedule C

-

D - carries to the Pennsylvania Schedule D

-

F - carries to the Pennsylvania Schedule F

-

0 (zero) - prevents the item from being carried to the Pennsylvania return

4797 screen

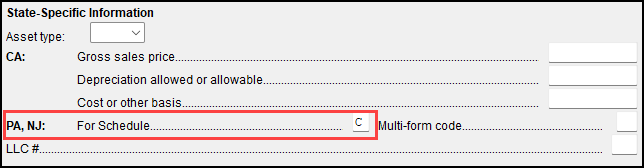

Enter the appropriate PA Schedule in the box labeled For Schedule at the bottom of the screen.

-

C - carries to the Pennsylvania Schedule C

-

D - carries to the Pennsylvania Schedule D

-

F - carries to the Pennsylvania Schedule F

-

0 (zero) - prevents the item from being carried to the Pennsylvania return