PA - Schedule D Not Produced

Article #: 18529

Last Updated: December 05, 2024

In an individual return, Pennsylvania Schedule D is not produced if the gain/loss is zero. (Review Federal Schedule D in View/Print mode.)

You can force the PA Schedule D to be produced by following these steps:

-

On federal screen 8949, change the ST drop list to 0 to prevent the amount from being reported twice.

-

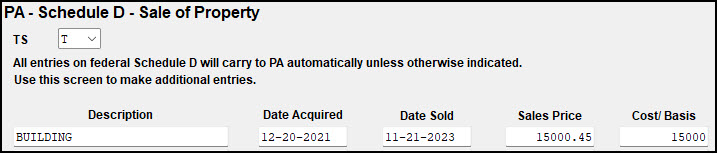

Manually enter the sale on PA screen D, with the following exception:

-

Enter the Sales Price with "$0.45" more than the Cost/Basis.

-

Press Ctrl + F to force the amount to be accepted.

-

For example, if the actual sales price was $15,000, type 15000.45 and press Ctrl + F to go to the next field. Then enter the Cost/Basis without any decimal amount (15000).

-

-

Repair the return by pressing Ctrl + Shift+ R.

-

Recalculate, then view the return.

-

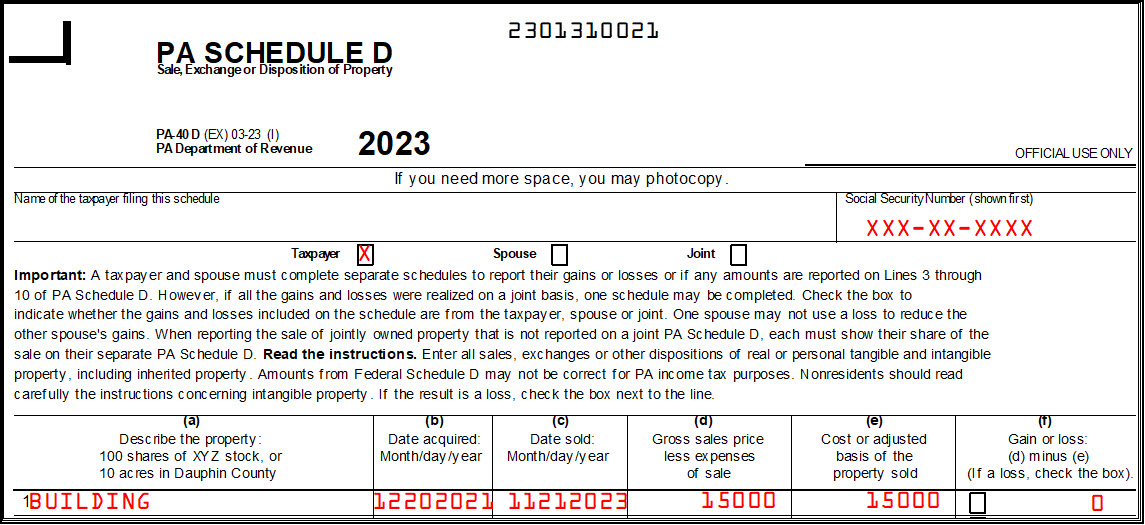

PA D (SCHD0001) is produced in View/Print mode, showing zero gain or loss.