Drake Tax - PA-40 - Schedule G-L

Article #: 16741

Last Updated: December 05, 2024

For a small number of joint returns, Drake Tax does not have the ability to allocate the income or tax paid correctly between the taxpayer and spouse, and it instead attributes it all to the primary taxpayer for a given state. When that happens, it is necessary to use PA screen GL to split the figures between taxpayers correctly, to adjust or eliminate the taxpayer’s share of income, and to add the spouse’s other state income and tax manually to the PA Schedule G-L screen (Pennsylvania > Credits tab > GL screen).

First verify whether the taxpayer has income items belonging to the other state and whether he or she owes tax to that state.

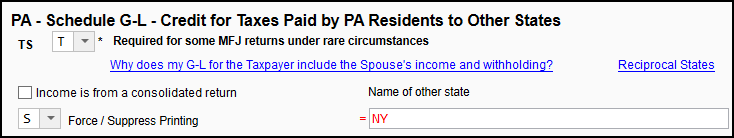

If the taxpayer doesn’t have both, suppress the taxpayer’s Schedule G-L (as follows):

-

Choose T in the TS box.

-

Choose S in the Force/Suppress Printing drop list.

-

Enter the name of other state.

-

Enter the income's Source (Entity name), for example W2.

-

Enter the income amount in the applicable line (i.e. W2 income on Compensation line).

If the taxpayer is eligible for the other state tax credit, examine the Primary Taxpayer’s PAGL form and determine which amounts need to be overridden. Use PA screen GL coded for the Taxpayer to override as necessary.

Analyze the Spouse’s Return

First, verify whether the spouse has income items and owes tax to the other state.

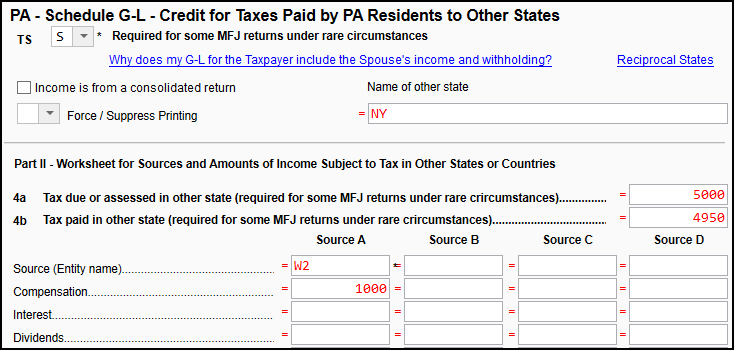

If the spouse does, complete the PA GL screen with:

-

TS box selected as S.

-

Enter Name of other state in the override box.

-

Enter the spouse’s portion of other state tax due and paid (boxes 4a and 4b).

-

Enter the income's Source (Entity name), for example W2.

-

Enter the income amount in the applicable line (i.e. W2 income on Compensation line).

-

Review the PAGL form in view mode and make any other necessary entries or overrides.

If the spouse does not, you can use the PA GL screen to suppress the calculation or printing.

For more information about the PA Schedule G-L, see the instructions.