Drake Tax - PA - Schedule M Capital Gains

Article #: 16785

Last Updated: December 05, 2024

Section 1231 gains reported on the Federal Form 4797 may be completely ordinary, completely capital, or a mix of both ordinary and capital gains. By default, Drake Tax assumes that the entire gain for Pennsylvania purposes is ordinary because:

-

Most depreciable tangible personal property assets do not appreciate in value, making a capital gain more rare than the recapture of already claimed deprecation.

-

A gain reported on Form 4797 is typically split between ordinary (deprecation recapture) and capital (the excess sales price over the asset’s cost).

-

-

Pennsylvania considers assets that are replaced in the business to be “ordinary” and not “capital” by nature. The software is unable to determine whether or not the asset will be replaced. As the preparer, you must make the final determination of whether the gain is ordinary (default) or capital, and make adjustments as needed.

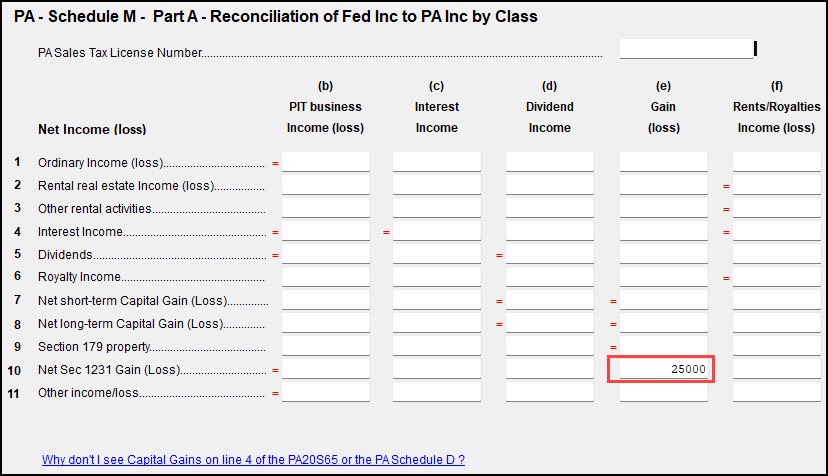

If the gain should be considered a capital gain, or if the gain is both ordinary and capital, you can allocate amounts differently by going to PA > General tab > M1 screen > line 10, column E.

An entry here tells the program how much of the net section 1231 gain is capital gain. Once you have indicated on the Schedule M that the 1231 gain is a capital gain, rather than an ordinary gain, any remaining adjustments can be made with the PA Schedule D (PA > General tab > D1, D2, or D3 screen(s)). This allows for the results to be reported on line 5 of the PA20S65 and then allocated to each partner or shareholder on their PA Resident or Non-Resident Form K-1.

For more information, see the PA-20S/PA-65 Instructions.