Drake Tax - CA - Form FTB 3504

Article #: 17783

Last Updated: December 05, 2024

Individuals who reside within California Indian country and meet the tribal income exemption requirements can use form FTB 3504, Enrolled Tribal Member Certification, to calculate and report the income subtraction.

In order to produce form FTB 3504 in Drake, the federal schedule that the income applies to must be completed and indicated as Native American income.

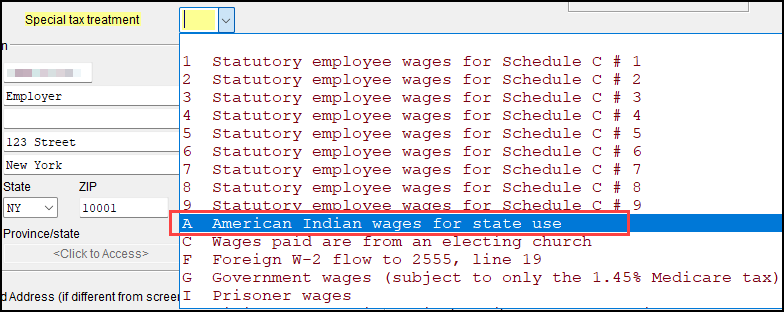

For Form W-2 income, select code A in the Special tax treatment drop list at the top of the W2 data entry screen.

For Schedule C and Schedule F income, select the Native American income check box on the Carryovers/State Info tab of the respective data entry screen.

For Schedules K-1 (from a partnership, S corporation, or fiduciary), enter the amount of income that is considered Native American income in the For State Use Only section of the applicable K1 screen (K1P, K1S, or K1F).

If the income is reported on a 1099-MISC or 1099-NEC, but neither a Schedule C nor a Schedule F will be filed, CA screen 3504 will need to be manually filled out as applicable.