Drake Tax - 8949: Entering a Wash Sale

Article #: 11360

Last Updated: December 05, 2024

A wash sale occurs when you sell or otherwise dispose of stock or securities (including a contract or option to acquire or sell stock or securities) at a loss and, within 30 days before or after the sale or disposition, you

-

buy substantially identical stock or securities,

-

acquire substantially identical stock or securities in a fully taxable trade,

-

enter into a contract or option to acquire substantially identical stock or securities, or

-

acquire substantially identical stock or securities for your individual retirement arrangement (IRA) or Roth IRA.

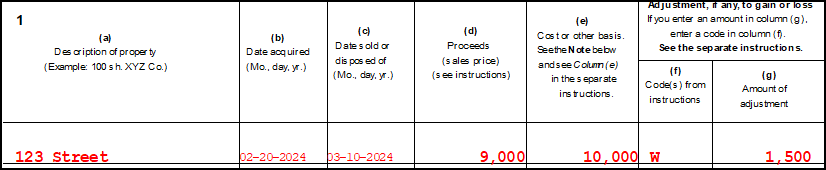

Open the 8949 screen (the Income tab). Enter all information as needed regarding the sale.

-

If the wash sale was reported in box 1g, enter it there and the 8949 will be adjusted for the disallowed loss.

-

If the non-deductible loss was not reported on box 1g, you can select code W in the adjustments section for the first Form 8949 adjustment code, and enter the adjustment amount.

With either entry, the software will indicate that it is a wash sale in column (f) of the 8949 and adjust for the disallowed loss.

For more information see the Schedule D Instructions.