Drake Tax - Opportunity Zones and Qualified Opportunity Funds

Article #: 15713

Last Updated: December 05, 2024

To enter or indicate that a gain is due to Qualified Opportunity Funds, first, enter information about the original transaction to report the gain from the opportunity zone. If this should be reported on Form 8949, use screen 8949. To indicate that a gain is from an opportunity zone, and that you want to postpone all or part of that gain, you must create a separate screen 8949 than the original transaction that created the deferred amount. Page Down to create the second screen 8949 and enter all of the following to prevent EF Message 6299 and properly show the deferral:

-

1a Description of property

-

EIN (QOF Only)

-

1b Date acquired

-

2 Type of gain or loss

-

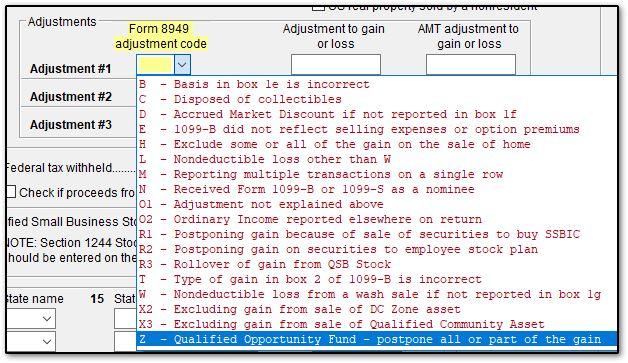

For the row Adjustment #1 - select code Z in the Form 8949 Adjustment Code drop list:

-

Adjustment to gain or loss - enter the amount to be deferred as a negative

You cannot have any entries in the QOF 8949 screen in the following boxes, per IRS guidelines:

-

1c Date sold or disposed

-

1d Proceeds from sale of stocks, bonds, or other capital assets

-

1e Cost or other basis

-

1f Accrued market discount

-

1g Wash sale loss disallowed

-

4 Federal tax withheld

-

7 Mark if loss based on amount in box 1d not allowed

-

12 Check if proceeds from collectibles

For more information on Opportunity Zones, see the IRS's Opportunity Zones Frequently Asked Questions and Form 8996.

Per the 8949 Instructions, "If you elect to defer tax on an eligible gain by investing in a QOF, you will also need to complete Form 8997." Form 8997 is available in Drake Tax.