Drake Tax - Schedule D: Capital Loss Carryover

Article #: 11406

Last Updated: December 05, 2024

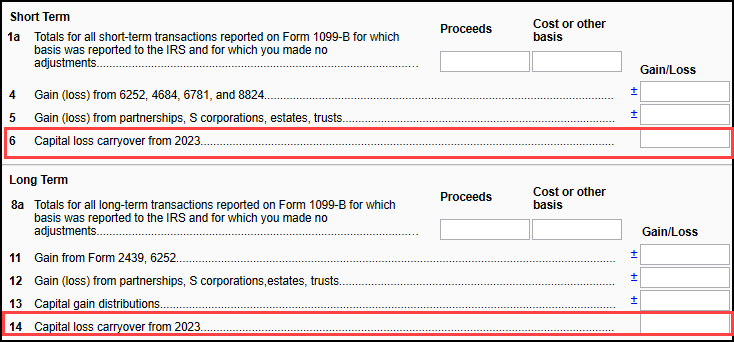

Capital loss carryovers from a prior year may be entered on the D2 screen (on the Income tab). The short term capital loss carryover on line 6, and long term on line 14.

Schedule D, line 21 requires that up to $3000 ($1500 for married filing separate) of a taxpayer's combined net short-term and long-term capital loss be reported on Form 1040, line 7 without regard to whether it is used in its entirety in the current year.

The loss on Form 1040, line 7 becomes part of the adjusted gross income (AGI) on Form 1040. If the AGI on the return reduces Form 1040, line 11 to a negative amount, part or all of the line 7 loss is carried forward. In View mode, the page labeled Wks Loss (Capital Loss Carryover Worksheet) shows the calculation for what portion of the loss is available to be carried forward.