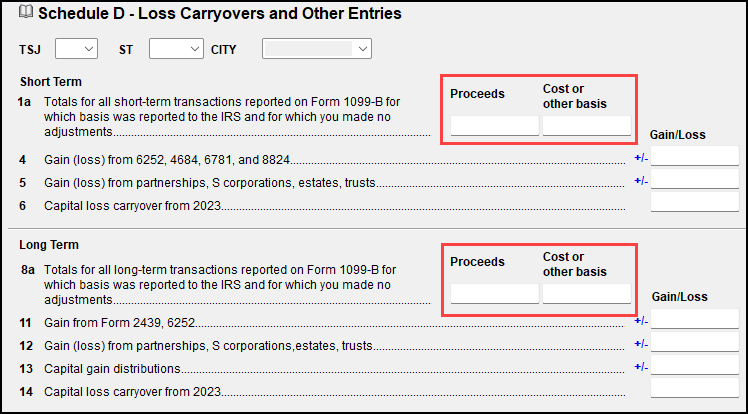

Drake Tax - Schedule D: Lines 1a and 8a

Article #: 12530

Last Updated: December 05, 2024

You have the option of reporting some stock brokerage transactions as totals on lines 1a and 8a of Schedule D without entering or generating Form 8949.

The Instructions for Schedule D state:

"You can report on line 1a (for short-term transactions) or line 8a (for long-term transactions) the aggregate totals from any transactions (except sales of collectibles) for which:

You received a Form 1099-B (or substitute statement) that shows basis was reported to the IRS and doesn't show any adjustments in box 1f or 1g;

You do not need to make any adjustments to the basis or type of gain or loss reported on Form 1099-B (or substitute statement), or to your gain or loss."

You can use screen D2 to make direct entries on lines 1a and 8a.

Enter the total sales price in the Proceeds field and the cost or other basis in the Cost or other basis field.

Note that you cannot have negative amounts on certain lines of Schedule D per IRS e-file guidelines. If a negative amount is accurate, the return will have to be paper-filed. EF Message 2602 generates preventing e-file.