Drake Tax - 8949: Code on Part I or II

Article #: 13157

Last Updated: December 05, 2024

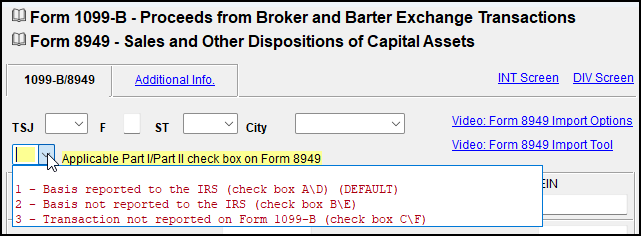

Open the 8949 screen (on the Income tab). Select the appropriate designation from the drop list for the field Applicable Part I/Part II check box on Form 8949:

Codes A, B, and C relate to short-term transactions. Codes D, E, and F relate to long-term transactions.

If selecting the code does not work, check the dates of acquisition and sale/exchange on the 8949 screen (lines 1b and 1c). Also review line 2 to be sure the term of the transaction is correct.

Lines from the 8949 flow to Schedule D, Capital Gains and Losses.

For more information about reporting information on Form 8949 and Schedule D, see:

Instructions for Schedule D (1040) or the instructions for other packages (go to IRS Forms/Publications Lookup)