Drake Tax - PA: Splitting Tax Between School District and Municipality

Article #: 12242

Last Updated: July 22, 2025

Drake Tax 2024 and future

Starting in Drake Tax 2024, when a School District splits, Drake Software will release a patch to update the Tax Rate Database.

Important The following information only applies to Drake Tax 2023 and prior.

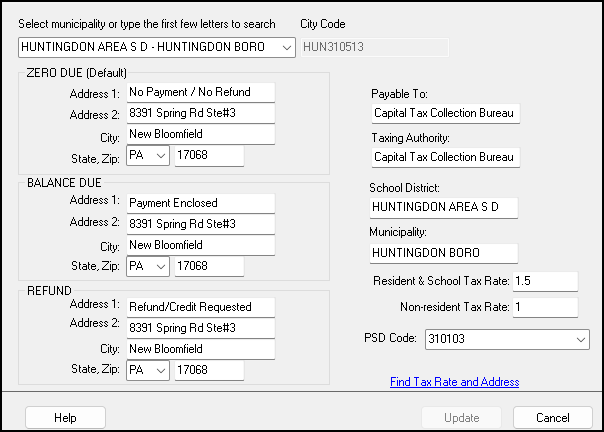

You can create separate school district and municipal databases using the PA City Tax Rate Editor. The steps to do this are shown below using the Huntingdon Area school district and Huntingdon Boro as an example. These two tax jurisdictions have a combined residential tax rate of 1.5%. The example creates two databases to separate the resident component tax for each jurisdiction, and uses the new databases to create separate returns for each jurisdiction.

Set up the City and School District Tax Rate Databases

-

Confirm the combined school district/municipal tax rate database.

-

Go to Tools > City Tax Rates > Pennsylvania to open the PA City Tax Rate Editor.

-

Select the appropriate School District and municipality needed. Make sure the correct tax rate information is listed. If it is not, enter the correct information and click Update to save the correction.

-

-

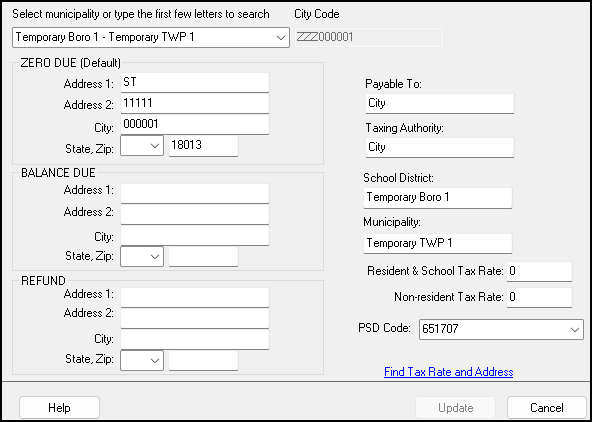

Set up the municipal tax database. Either municipal or school district database can be set up first. The example proceeds first with the municipal database.

-

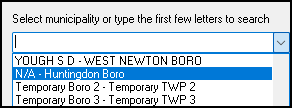

While still in the City Tax Rate Editor, select Temp S D # from near the bottom of the drop list, where # is a placeholder temporary school district. You can select any Temp S D #.

-

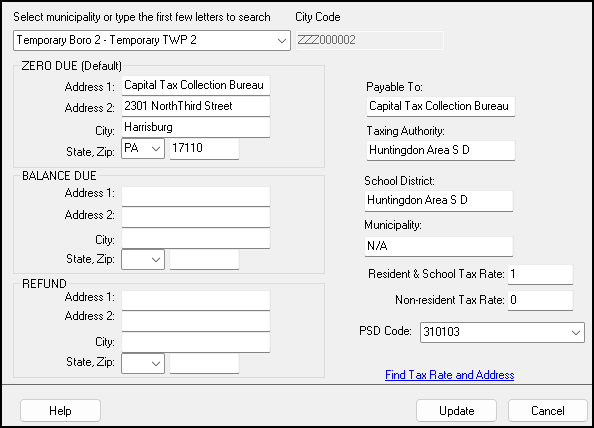

The selection opens a new screen for editing.

-

Note: Do not try to edit the Temporary field. The database name is fixed. The name will be modified by the software for display in the PA City Tax Rate Editor based on your entries.

-

The tax rate, municipality, school district, and other necessary information are available online by clicking the Find Tax Rate and Address link on the screen above to open the Municipal Statistics web page. From the Taxes menu, select Taxes > Tax Registers > EIT / PIT / LST Tax Registers (Real-Time) and complete a search for the jurisdiction to display tax information. For a printable version, repeat the process at Taxes > Tax Registers > EIT / PIT / LST Tax Registers (Real-Time) - Printable.

-

To provide a separate database for the municipality, complete the PA City Tax Rate Editor. For the municipal tax rate, the School District can be entered as N/A. Note the City Code field. When complete, click Update.

-

After updating, confirm the new municipal database in the PA City Tax Rate Editor. You can open and edit it if necessary.

-

-

Set up the school district tax database. Repeat the process above to create the school district database. The Municipality can be entered as N/A:

Note the City Code field, ZZZ000002 in the example. After updating, confirm the database in the PA City Tax Rate Editor.

Complete the two PA LOCAL returns

-

If the taxpayer is a PA resident, then you must enter LC in the Resident city field of federal screen 1.

-

You must enter LC in the resident city/locality drop list for any W-2, Schedule C or other taxable income sources in the taxpayer’s return.

-

Create the local returns. In data entry in the PA return, go to the LOC screen on the Local tab.

-

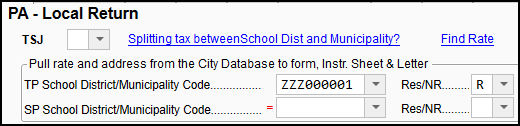

Create the municipality return. Using the appropriate School District/Municipality Code drop list, the first selection, ZZZ000001 in the example, is for Huntingdon Boro (only the Temp names are displayed here):

-

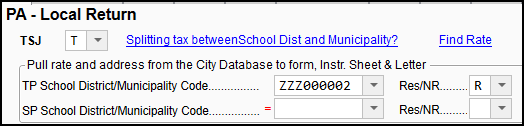

Create the school district return. To create a second return, press Page Down. Using the drop list, the second selection, ZZZ000002 in the example, is for the Huntingdon Area S D:

-

-

View the return. There are two PA Local returns: