Drake Tax - 1099-K: Data Entry

Article #: 10520

Last Updated: October 24, 2025

Separate entry of Form 1099-K is not required by the IRS. Within Drake Tax, gross receipts received via payment card (credit and debit cards) and third party network payments can be entered on the following screens as an undifferentiated part of gross receipts:

-

Screen C - Schedule C

-

Screen E - Schedule E

-

Screen F - Schedule F

-

Screen 99K - State Use Only

-

Screen INC in 1120, 1120-S and 1065 returns

-

Screens 3 and 5

Tip Other Federal Withholding from Form 1099-K can be entered on screen 5, line 25c. Only the amount entered flows to the Federal Withholding worksheet.

Watch the video Form 1099-K for a demonstration.

Issuing Threshold

Under the new new tax bill, third-party settlement organizations must file Form 1099-K if both of the following are true:

-

The total payments exceed $20,000.

-

The number of transactions exceeds 200 within a calendar year.

The relevant data entry remains the same. See the IRS FAQ for details.

Special Situations

Starting in Drake Tax 2024, for special Form 1099-K situations where Form 1099-K was issued for personal items sold at a loss, or for a Form 1099-K that was received in error, use the taxpayer or spouse box Enter the amount reported to you on Forms(s) 1099-K that was included in error or for personal items sold at a loss at the top of screen 3. The amount displays at the top of Schedule 1 in View/Print mode.

Note Any other amounts reported on Forms 1099-K should be reported on the tax return as previously discussed.

For special Form 1099-K situations where Form 1099-K was issued for personal items sold at a loss, or for a Form 1099-K that was received in error, use the drop downs for line 8z on the screen 3. Choose Form 1099-K Personal Item Sold at a Loss or Incorrect Form 1099-K, as appropriate. Drake Tax will automatically complete line 24z with the same amount to offset the transaction with zero effect on the return.

State Use Only

Form 1099-K data entry is available for state returns only. Data entered on the 99K screen located on the States tab, is used to produce a copy of Form 1099-K for certain states that require the source document for e-file purposes. State tax withheld entered in box 8, is the only amount that flows to a state form.

Important The 99K screen is only for use by states that require the source document - no data entered flows to a federal form.

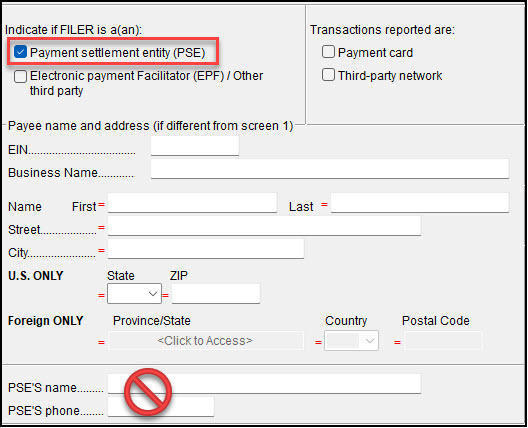

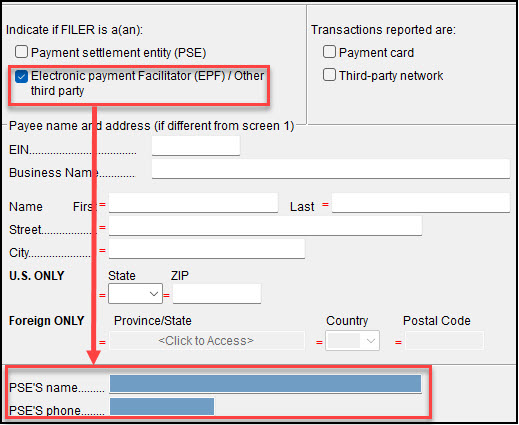

PSE or EPF/Other

Payment settlement entity (PSE) or Electronic payment Facilitator (EPF)/Other third party filer section should be used if applicable, however, note the following entry requirements.

On the 99K screen, if the PSE check box is marked, do not complete the PSE's Name and PSE's Phone fields at the bottom of the screen. Those fields are only used If the FILER is an Electronic payment Facilitator (EPF)/Other Third Party and that box is marked instead. A message generates if you make conflicting entries.

For more information about IRS requirements for Form 1099-K, see General FAQs on Payment Card and Third Party Network Transactions.